By: Amber Hestla, Michael J. Carr

The head-and-shoulders (HS) top is one of the best-known patterns in technical analysis. This pattern was first written about in 1930 by a financial editor at Forbes magazine who described how the HS forms and how it can be traded.

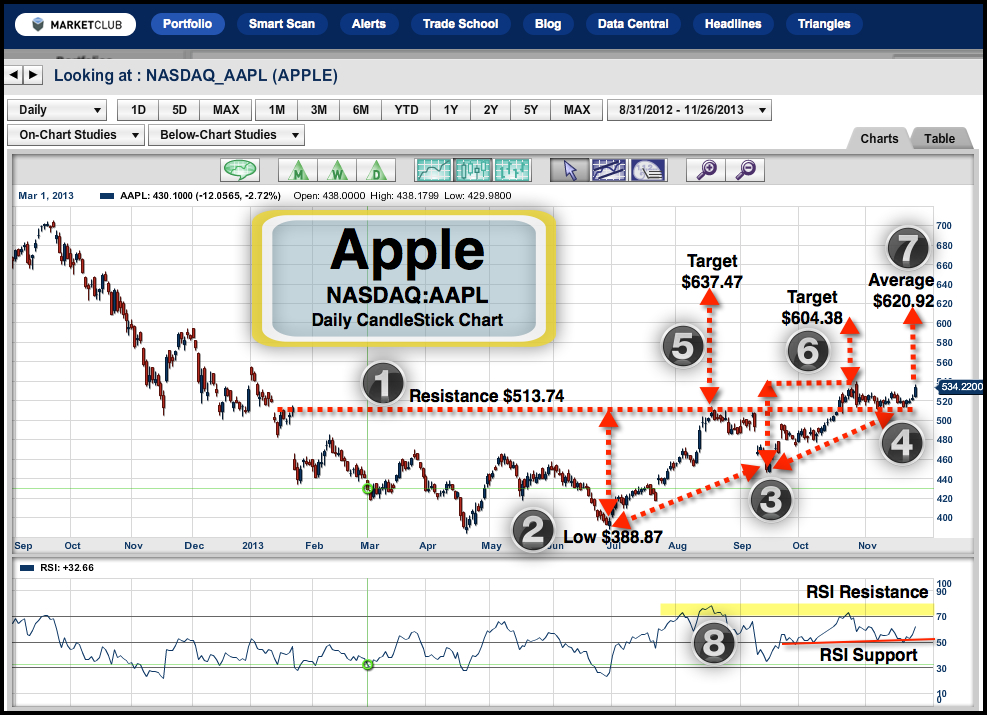

Many readers are familiar with the HS pattern. On a price chart, there will be three peaks in price at the end of the uptrend, with the center peak (the head) being higher than the other two. The peaks on the sides (the shoulders) should be about equal in height. Continue reading "This Pioneering Chart Pattern Is Still One Of The Best"