Today's author is Jackie Ann Patterson, the editor of BackTesting Report. Previously Jackie Ann showed us how to pick up on a potential trend change as well as how to recognize a mature trend using the MACD indicator. Today she has returned to the Trader's Blog to share a method for testing your trading strategy.

Today's author is Jackie Ann Patterson, the editor of BackTesting Report. Previously Jackie Ann showed us how to pick up on a potential trend change as well as how to recognize a mature trend using the MACD indicator. Today she has returned to the Trader's Blog to share a method for testing your trading strategy.

----------------------------------------------------------------------------------------------------------------------------------------------------

One of the ways that traders use to determine the success of a potential strategy is to use a baseline. A baseline is a benchmark or a standard for comparison. For example, some investors will use the gain/loss of the S&P 500 as a baseline of market performance. That may be useful for investing long-term in large-caps, but less applicable to active investing and shorter-term trading. This article shows you a different method of forming baselines and the win rate results for two types of stock market participants. Continue reading "Baseline for Active Investing"

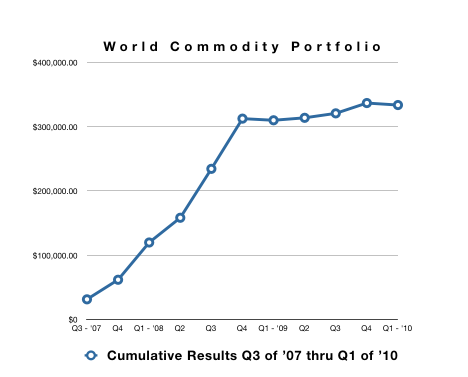

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.