Does it sound strange to even think about "taking profits" on anything related to energy?

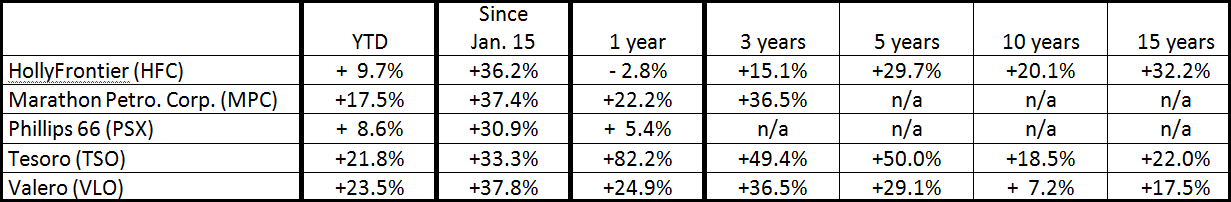

Well, oil refining companies' stocks have enjoyed quite a run this year. Check out this table summarizing recent returns for 5 selected stocks (total returns through 2/20/15, from Morningstar; returns longer than 1 year are annualized; "since Jan. 15" data from Yahoo! Finance):

If you haven't paid attention to this group, how surprised are you to see a group of oil-related stocks with positive returns over the past 12 months – let alone Tesoro's +82% performance?!!

I've also included the 3-, 5-, 10, and 15-year returns, just because they're so remarkable.

Oil down, refiners up!

Of course, the driving reason for this group's stellar 1-year returns is that oil refiners actually benefit from being able to pay lower prices for crude oil, which is the primary raw material used to make their refined products, such as gasoline. Continue reading "Is It Time To Take Profits On Oil Refining Stocks?"