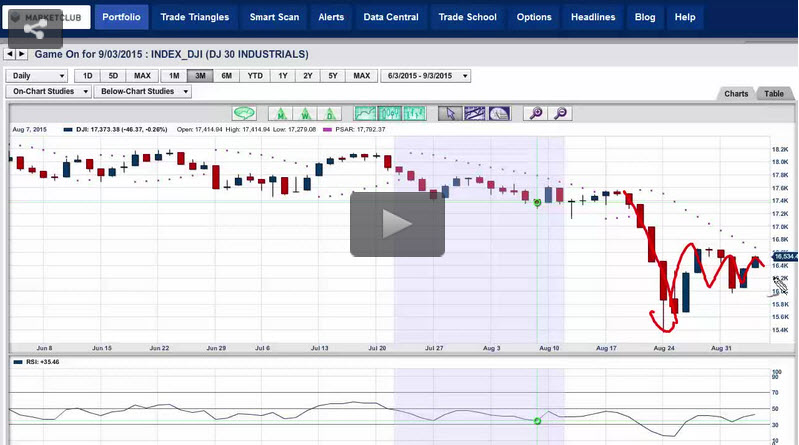

Even before the announcement of non farm payrolls, which is one of the most significant data releases of the summer, the markets were on the decline. One of the reasons for that has to be yesterday's market action, all the indices fell from their best levels of the day and closed at or close to the lows.

Yesterday's close in both the Dow and the S&P 500 was on target to be the lowest Friday close if nothing happened today. The fact that we are down sharply this morning is a huge negative in my book, but is not one that is surprising.

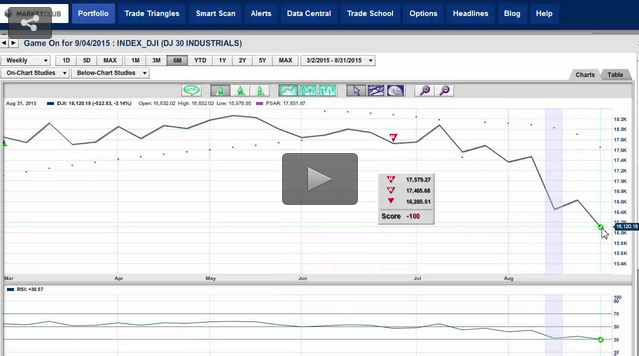

As we go into the long Labor Day weekend look for the markets to be very thinly traded and volatile. I'm looking for a new low Friday close today. The lowest most recent Friday close was 16,559.75 on the Dow and 1,970.89 on the S&P 500. The NASDAQ was the only index to remain above its lowest Friday close yesterday by just a few points. The level to watch in the NASDAQ is 4,717.16, that level represents the lowest most recent close on a Friday. Continue reading "It's Friday And Things Could Get Ugly"