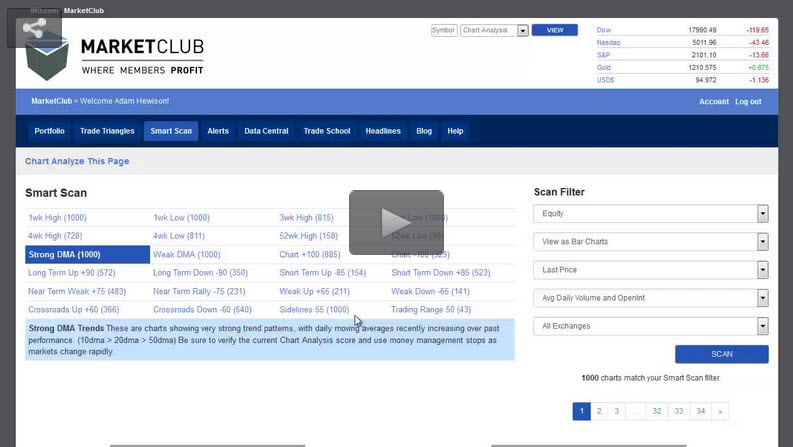

Hello traders MarketClub members everywhere. Today, I want to show you a quick and easy way to find stocks that are really moving and that you can catch for quick pop on the upside. It's not difficult, anyone can do this with just a few mouse clicks.

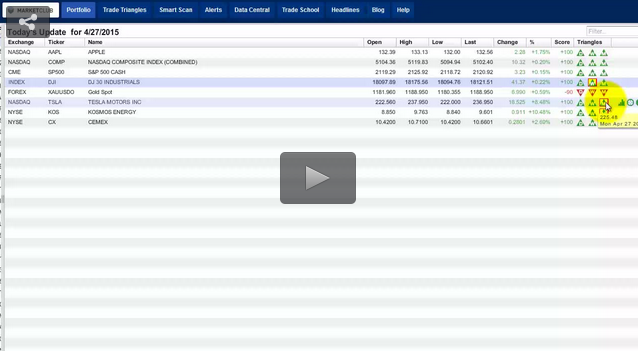

I found 3 stocks today that I like and I want to share those 3 stocks with you right now.

The first stock I found was Starwood Hotels & Resorts Worldwide Inc. (NYSE:HOT) currently trading @ 87.00.

Starwood Hotels & Resorts Worldwide, Inc., together with its subsidiaries, operates as a hotel and leisure company worldwide. The company owns, operates, and franchises luxury and upscale full-service hotels, resorts, residences, retreats, select-service hotels, and extended stay hotels under the St. Regis, The Luxury Collection, W, Westin, Le Méridien, Sheraton, Four Points, Aloft, and Element brand names. Continue reading "How To Find Stocks For A Quick Upside Pop"