Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Friday, the 10th of January.

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Friday, the 10th of January.

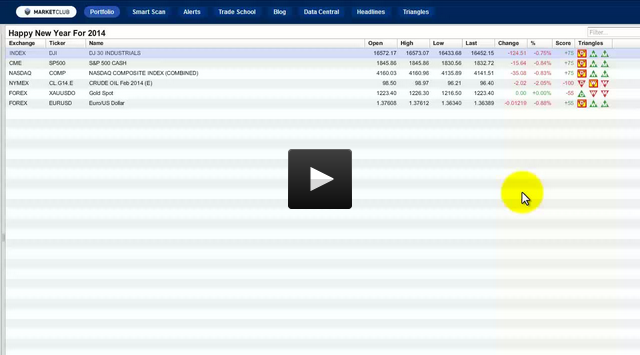

It seems to me as we are finally back to double digit temperatures here in the Mid-Atlantic there is a different feel in the market so far this year. As we ended 2013, stocks were buoyant and moving to new highs and as we move into the second week of trading in the new year, stocks seem to have lost some of their pizzazz.

Major Indices

While the major indices are still in a positive upward trend longer-term, it is increasingly apparent that they may just be running out of gas and upside momentum in the short-term. I'll be examining the three major indices today and share with you my take on what's happening in each index. Continue reading "The Big Market Vortex"