Amidst a backdrop of elevated inflation, near-record high gold prices, and negative real rates, many gold bulls are puzzled by the lack of upside follow-through in the Gold Miners Index (GDX). This is because, despite this favorable environment, the index is down 6% year-to-date and 40% from its Q3 2020 highs.

However, it’s important to note that the gold producers are up against significant headwinds which have dented margins, including higher labor, fuel, and materials costs. So, while they have historically performed well in this environment, some of the gold price’s upside has been offset by these rising costs.

Given that the GDX is littered with several high-cost producers with sub-par track records, this has weighed on the index’s performance, dragging down nearly all the stocks in the sector and the GDX.

The good news is that this 22-month decline (August 2020 – June 2022) has left some of the highest-quality miners sitting at their cheapest valuations since Q1 2020.

In this update, we’ll look at three miners that are not only less affected by the inflationary pressures but are trading at a significant discount to their historical multiples: Kinross Gold (KGC), Alamos Gold (AGI), and Wesdome Mines (WDOFF).

Kinross Gold (KGC)

Beginning with Kinross, the company is a 2.0-million-ounce producer with operations in Mauritania,

Brazil, Nevada, Alaska, and Chile.

The company has been performed the worst among its larger peers over the past year, punished by the acquisition of a development-stage project in Canada and after divesting its Russian assets this spring after the invasion of Ukraine.

While the latter development wiped out more than $1.0 billion in net asset value and 300,000 ounces of annual gold production, the company may be better positioned following the divestment, even if the assets were sold for less than fair value. This is because Kinross was not getting much value for its Russian assets (Kupol, Udinsk) anyways and can now command a higher multiple with an Americas-focused portfolio.

Understandably, investors are disgusted with the stock’s performance, with it down over 60% since Q3 2020. However, at current prices, the correction looks to be overdone.

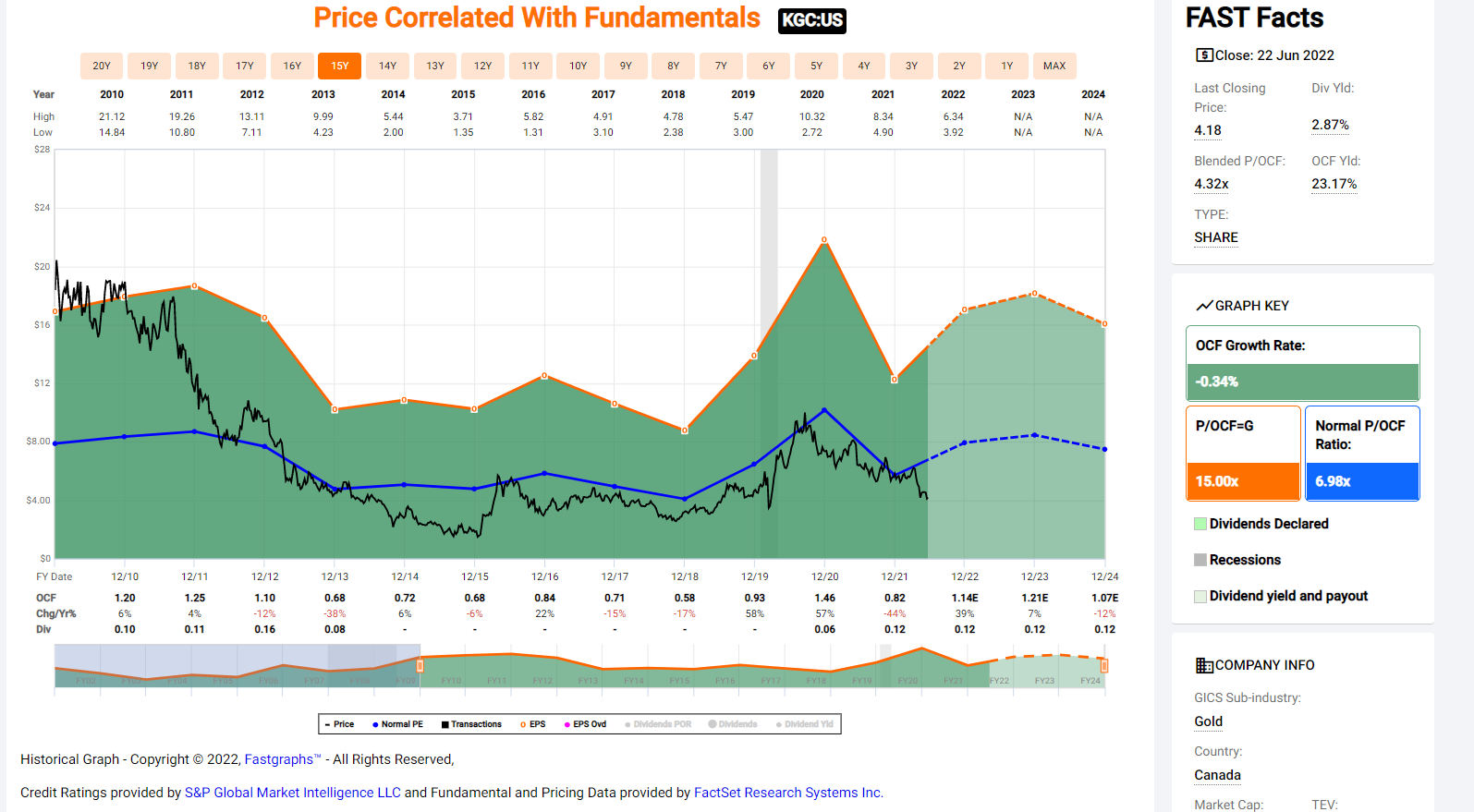

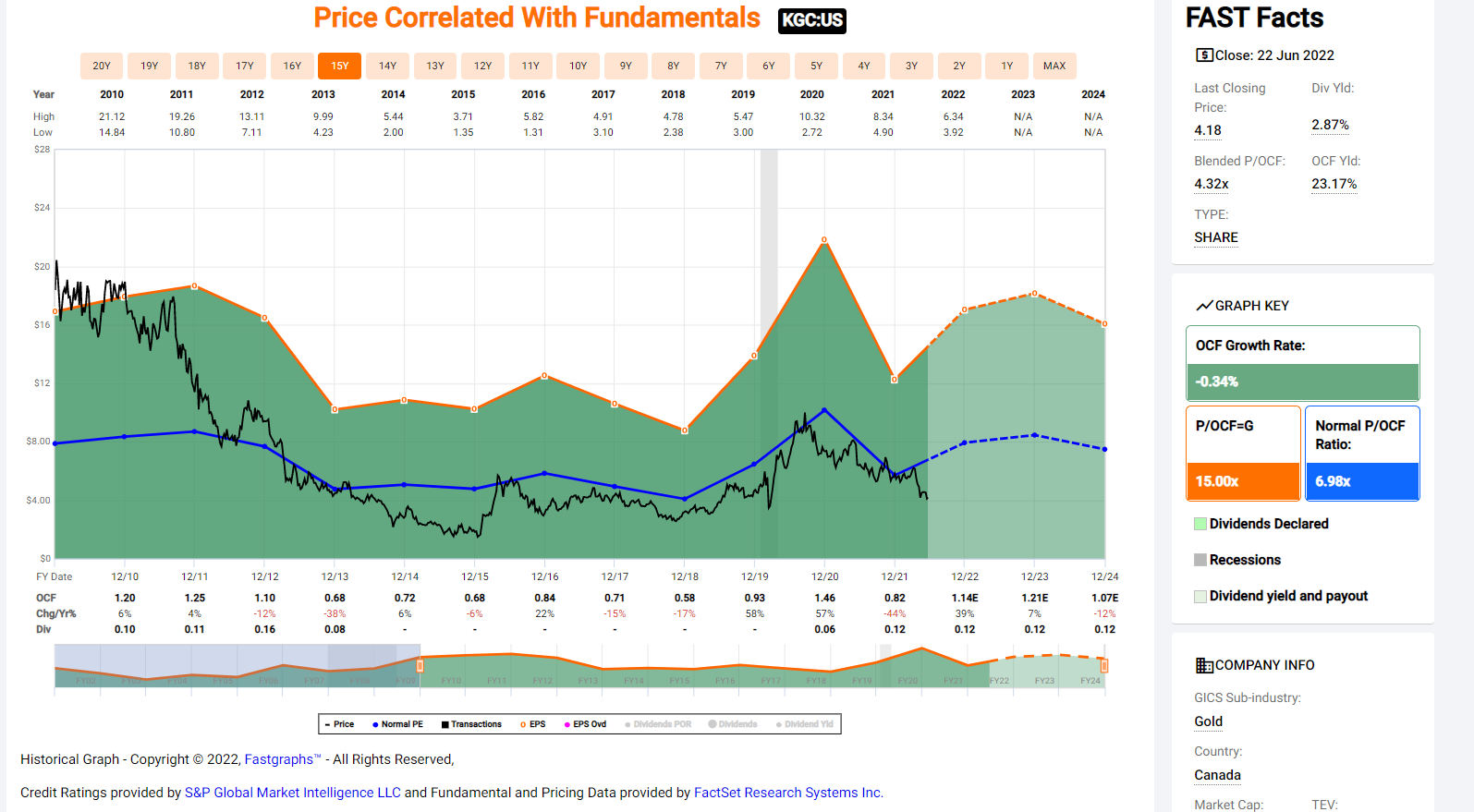

This is because Kinross has historically traded at 7x cash flow and is currently trading at 3.5x FY2023 cash flow estimates ($1.20 per share). While I think 7x cash flow is a high estimate and 5.5x cash flow is more appropriate, this still translates to a fair value of $6.60 per share, or more than 65% upside from current levels.

It’s also important to note that FY2023 cash flow does not factor in any upside from its Dixie Project that it recently acquired in Canada, which looks to be home to 9+ million ounces of gold and could produce 425,000+ ounces per annum at sub $800/oz costs.

Source: Kinross Historical Cash Flow Multiple, FASTGraphs.com

With production not expected to begin until 2028 at Dixie, this asset has been discounted and Kinross doesn’t get much value for the asset. However, I see a fair value for this asset of $1.7 billion, translating to more than $1.50 per share in additional upside long-term.

While the stock’s 18-month fair value lies 65% higher, the stock has the potential to more than double long-term if it can execute successfully at Dixie. Given this deep discount to fair value combined with a 3.0%+ dividend yield, I see the stock as a steal at $4.00

Alamos Gold (AGI)

The second name worth watching closely is Alamos Gold, a mid-tier gold producer currently churning

out 450,000+ ounces per annum from its three operations in Canada and Mexico.

However, the stock has fallen out of favor recently, given that its costs have risen above $1,200/oz and are expected to come in at levels above the industry average in 2022.

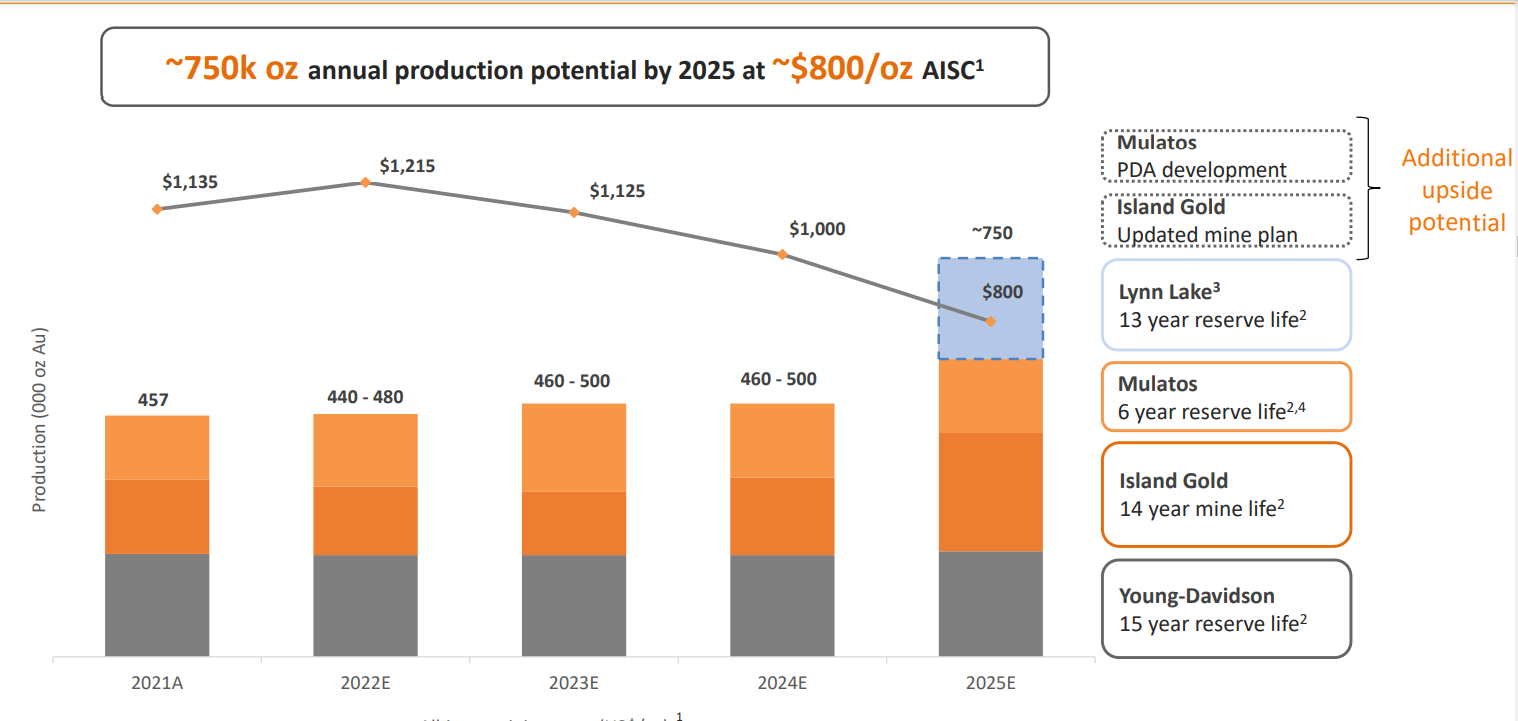

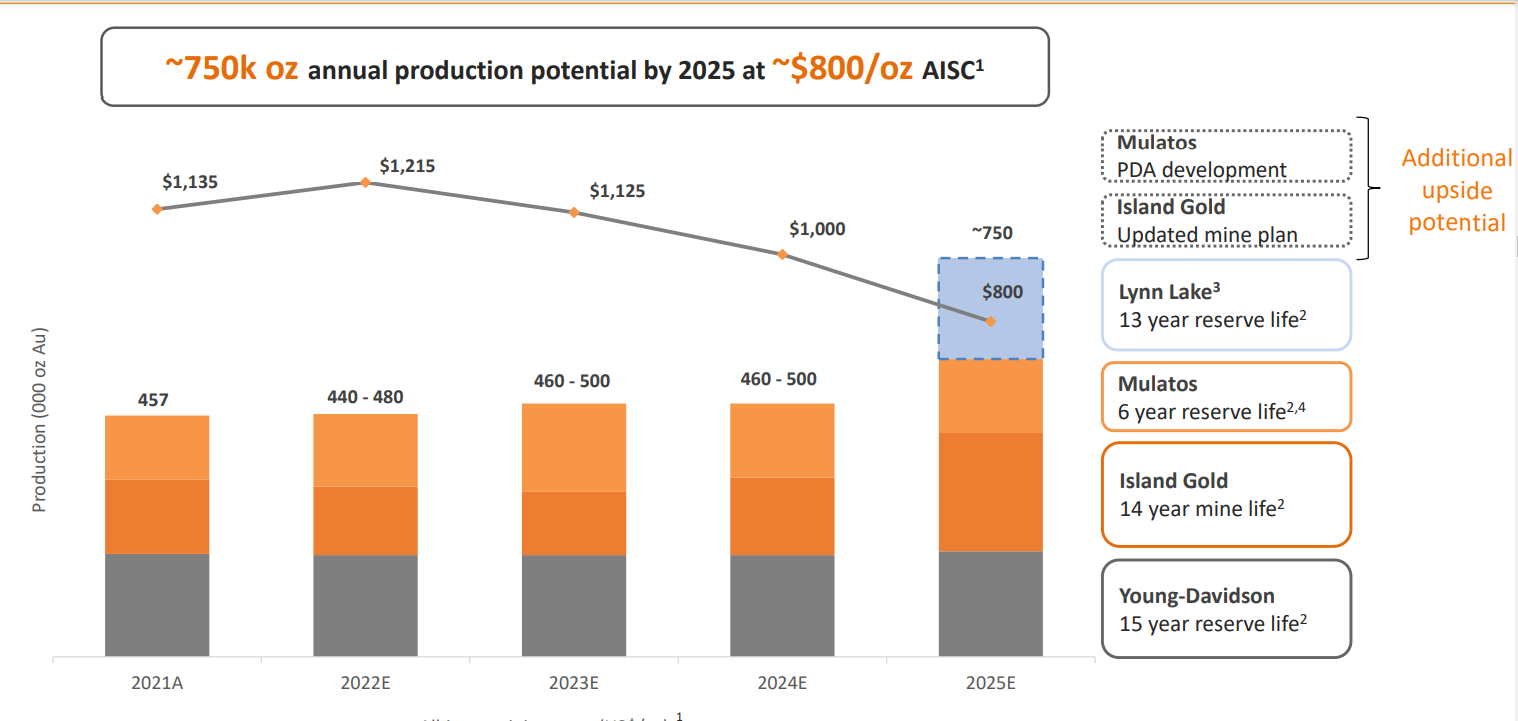

While this certainly dampens the short-term margin outlook ($1,130/oz costs in 2021), Alamos will look like a completely different company by the second half of 2025. This is because it’s currently constructing its Phase 3 Expansion at its high-grade Island Gold Mine, which will push production from ~125,000 ounces per annum to 230,000+ ounces per annum.

Meanwhile, the company aims to construct a 4th mine in Manitoba (Lynn Lake), adding another

150,000 ounces per annum by 2026.

Source: Alamos Gold Growth Plan, Company Presentation

If Alamos was only a growth story, it would be unique, and we would already expect it to command a

premium multiple in a sector where growth is hard to find.

However, it’s important to note that this growth will be accompanied by significant margin expansion and a jurisdictional upgrade. This is because its Phase 3 Expansion which will nearly double throughput, is expected to contribute to sub $600/oz costs at Island.

At the same time, Lynn Lake’s costs should come in below $975/oz. The result will be a transformation from a 450,000-ounce producer at $600/oz margins ($1,800/oz gold price) to a ~750,000-ounce producer with $1,000/oz margins ($1,800/oz gold price.

Finally, it will see its exposure to Mexico (Tier-2 rated jurisdiction) dip from 30% to 20%. The result is a company that will enjoy expansion in its P/NAV multiple at the same time as its cash flow increases substantially.

Based on this outlook, I see a fair value for the stock above US$10.00 and view this pullback in AGI as a gift.

Wesdome Mines (WDOFF)

The final name becoming attractive is Wesdome Mines, a junior producer operating out of Canada with

one mine in Ontario and another in Quebec.

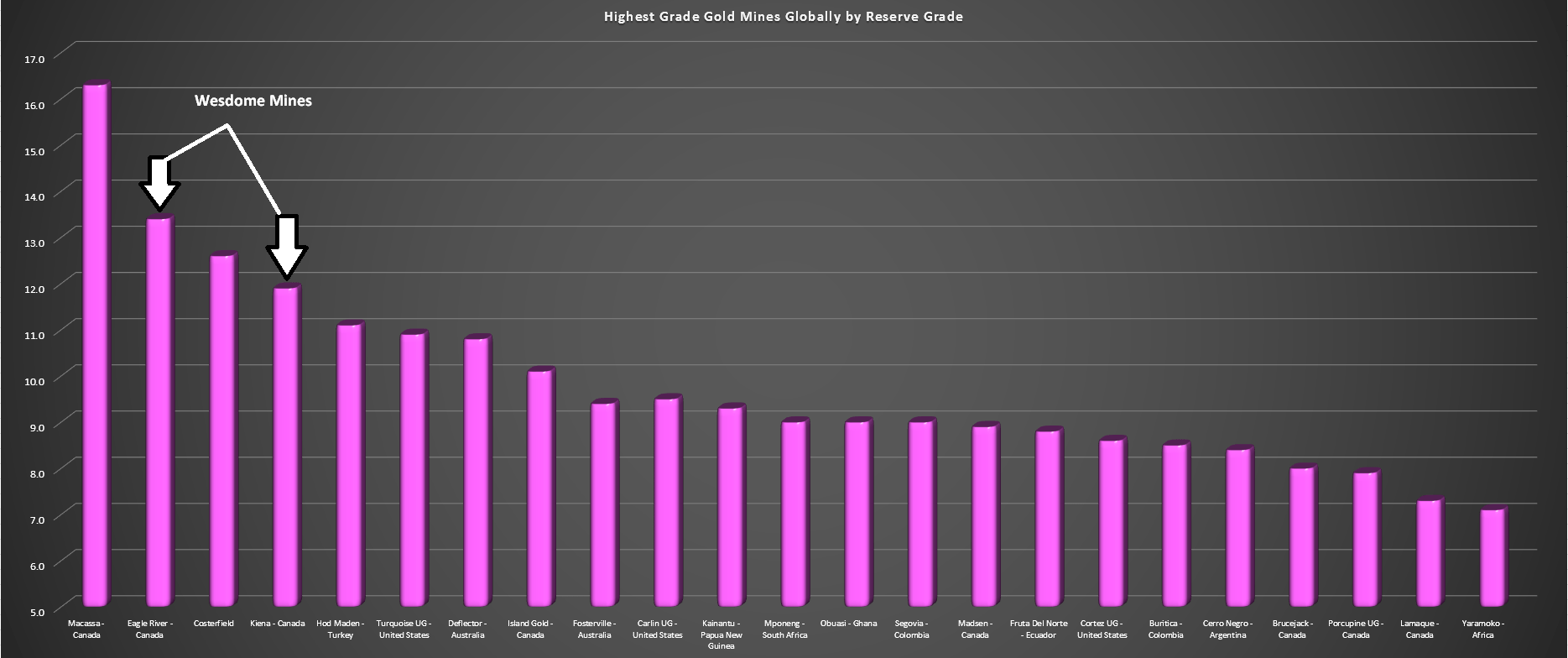

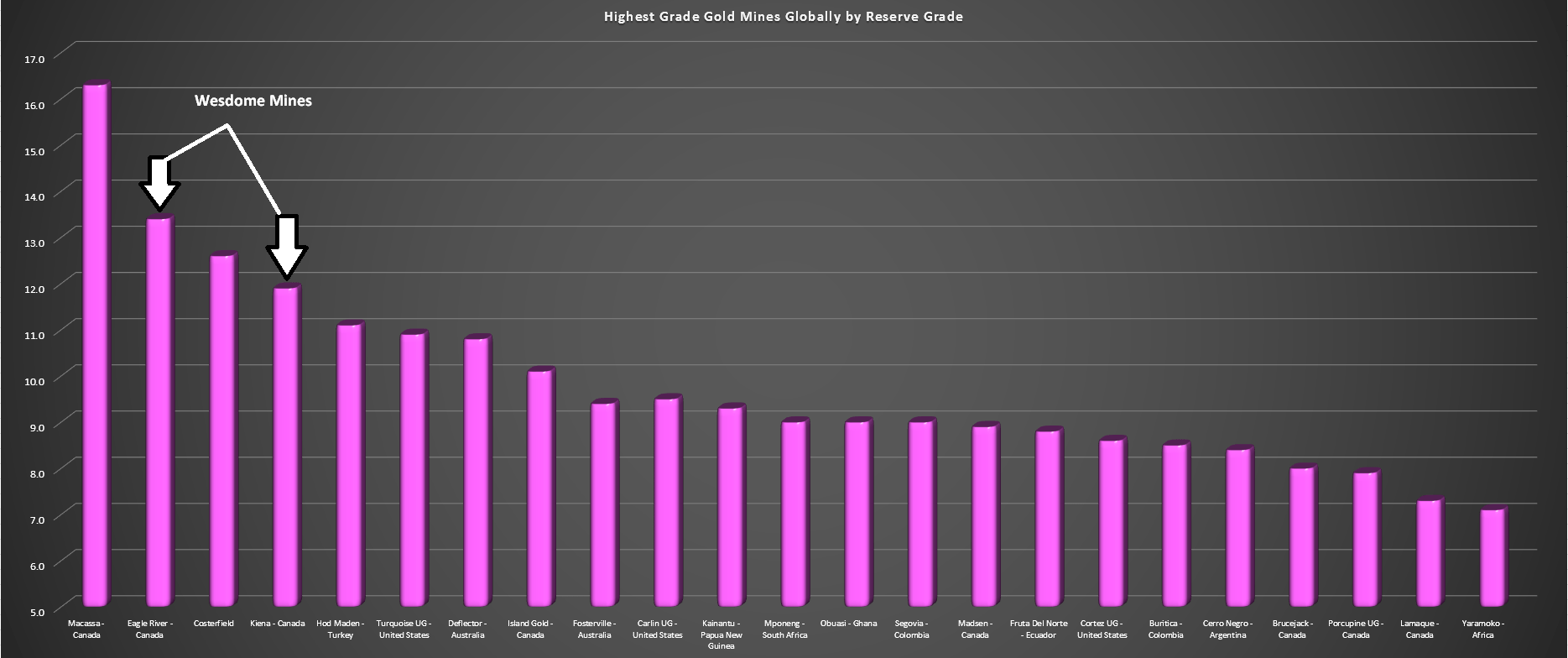

While junior producers are a dime a dozen, Wesdome is special given that it has two of the highest-grade gold mines globally, and it’s busy ramping up to full production at one of them (Kiena) over the next year.

Given its 10+ gram per tonne gold grades, it uses considerably less fuel and labor than its peers per ounce of gold produced, given that it’s moving less than one-sixth the rock volume given its grades.

Source: Highest Grade Gold Mines Globally, Company Filings, Author’s Chart

Wesdome’s steady ramp-up at Kiena means that while its costs may be above $1,100/oz currently,

they’re expected to slide to less than $825/oz by 2024.

Given this enviable position as a company with meaningful margin expansion on the horizon in a period of slight margin contraction sector-wide, I would view any pullbacks below US$8.00 (key technical support level) as buying opportunities.

Final Thoughts

With the gold miners trading at their largest discount to net asset value in two years, I see now as a favorable time to begin adding some exposure. Given KGC, AGI, and WDOFF’s improving margin profiles looking out to 2025, I believe they are three of the best ways to get exposure to the sector.

Disclosure: I am long AGI, KGC

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.