Hello traders everywhere. All three of the major indexes are marching along to record highs and looking to close the week out at record highs. This move higher is primarily due to Tax Reform, which is expected to be delivered by the GOP this afternoon.

Once delivered the Republican leaders hope to hold a vote on the legislation in the full House and Senate next week. President Donald Trump touted a tax cut regularly during his campaign and wanted an approved bill on his desk for his signature before Christmas.

It would be Trump's first major legislative victory since taking office in January.

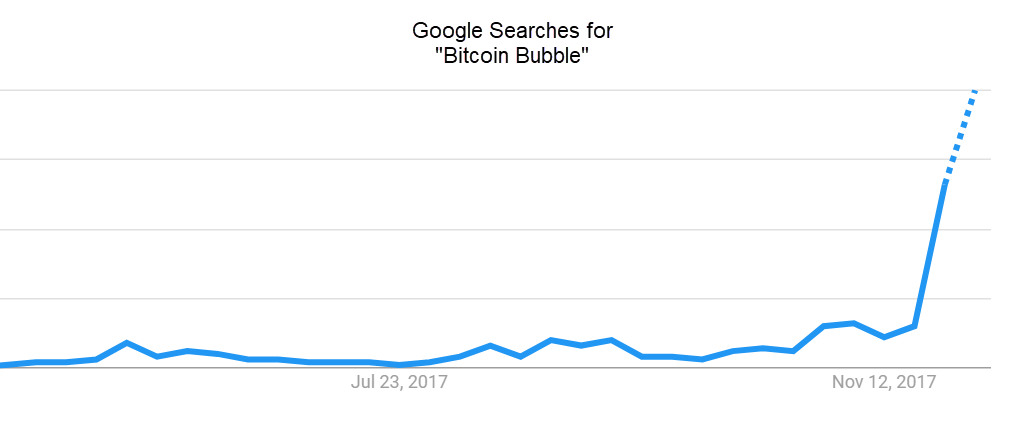

Bitcoin is close to another all-time high of almost $18,000 on the Bitstamp exchange on Friday, up 9% on the day, even as warnings grow over the risks of investing in the highly volatile and speculative instrument. This record push is partly due to the CME futures that are going to start trading on Sunday, which should see significant trading vs. the lighter volume that the CBOE saw last week.

Key levels to watch next week:

S&P 500 (CME:SP500): 2,598.87

Dow (INDEX:DJI): 23,545.02

NASDAQ (NASDAQ:COMP): 6,734.13

Gold (NYMEX:GC.G18.E): 1,242.30

Crude Oil (NYMEX:CL.F18.E): 57.83

U.S. Dollar (NYBOT:DX.H18.E): 92.13

Bitcoin (CME:BRTI): 8,889.74

Every Success,

Jeremy Lutz

INO.com and MarketClub.com