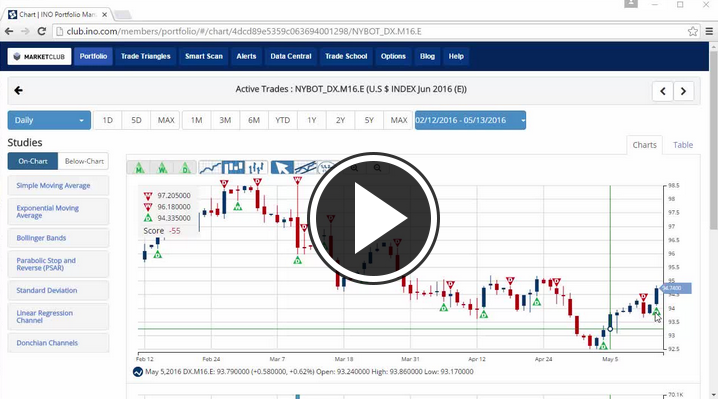

Hello MarketClub members everywhere. The Dollar has rallied while U.S. stocks have fluctuated this morning. The reason for the jump is retail sales; retail purchase jumped in April to the highest levels in a year. This indicates that consumer spending could help the U.S. economy recover from its early-year slowdown and possibly give the Fed a reason to raise rates next month.

Purchases climbed 1.3 percent last month, beating the economists estimates of a 0.8 percent gain. It's the biggest gain since March 2015 and comes after a 0.3 percent March drop that was smaller than previously reported, Commerce Department figures showed Friday in Washington. Continue reading "Dollar Jumps After Retail Sales Report"