What would be the first thing that came to mind if I asked you, "I want you to find, execute and manage multiple profitable options trades in less than 10 minutes"?

Is it confusion, panic?

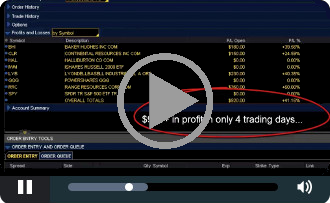

The truth is, not only is it possible to find, execute and manage profitable trades in less than 10 minutes a day, but my students and I have been doing it with an extremely high success rate for years and seeing double-digit returns in just days! In fact, +40% returns in just days using this system are not only possible, but they are completely achievable. I don't want you to take my word for it though, the fact is, results don't lie!

My name is Travis Wilkerson (AKA Trader Travis) and I'm the lead stock option trader and founder of the Option Profit Formula Success Academy. My mission has been to develop a trading method to put the power and leverage of options in regular traders' hands. I want traders, just like you, to reach their financial goals with a system that fits into their busy schedules and the demands of everyday life.

I challenge you to invest a few minutes of your time today to see how you can implement this 10 minute strategy for yourself. Follow along as I show you real results from this strategy in action, including the 40% return from 4 trades in just 4 days. There is no cost to see this strategy, no catch!

In this free video, you'll learn:

• How to determine if market conditions are optimal for options trading.

• How to determine which stocks make great option candidates.

• How to find and select the corresponding options chain.

• How to get real, consistent results including results on trades I place while you watch!

The best part is all of this can be done in 10 minutes or less!

This video is proof of why this strategy has become the go-to for my students and I. No trade-off. You watch, you learn, and then share with others.

Trust, but verify!

Trader Travis