We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

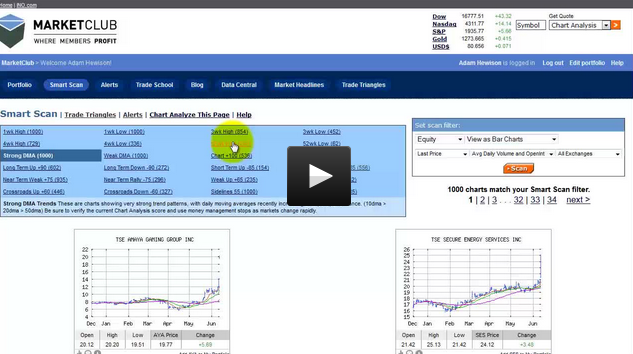

Gold Futures

Gold futures in the August contract settled last Friday at 1,252 an ounce while going out in New York today Friday the 13th at 1,274 an ounce trading higher by over $20 an ounce bucking its recent bearish trend. Currently I’m sitting on the sidelines and waiting for another trend to develop as the reason gold snap backed was in the last couple days 2 major cities in Iraq have been taken over by Al Qaeda and it’s a possibility that Baghdad is next bringing the possibility of U.S troops once again sending crude oil and the precious metals higher today. Gold is trading above its 20 day but still below 100 day moving average which stands at 1,296 so keep a close eye on this market as there’s a possibility prices may have bottomed in the short term due to the geopolitical risk. If you believe that prices have bottomed my recommendation would be to buy at today’s price while placing my stop below the recent low of 1,240 risking around $3,300 per contract in case the trend does change and if the Iraqi situation really flares up gold prices would move sharply higher in the short term just on short covering alone. The volatility in my opinion will start to increase over the next several months as it has remained low for some time now so you might want to look at put or call options because the premiums are relatively cheap.

TREND: MIXED

CHART STRUCTURE: IMPROVING