Today marks the last day of trading for the month of August and I have to say, it has been quite a month. With all the news about ISIS, the Ukraine and Hamas and Israel, you would think the world was coming to an end. Well, don't tell that to the stock market! It made all-time highs and put in a very solid month of returns in August.

Traditionally August has always been a rather slow month, as many traders and investors take off on vacation to spend time with family members and loved ones. This August was no different as trading volume slowed, but the market continued its upward trend.

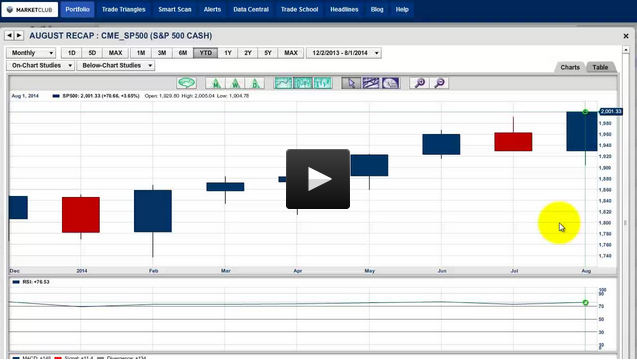

The big winner as far as the indexes are concerned is the NASDAQ (NASDAQ:COMP), which is presently trading approximately 4.61% higher for the month. Closely behind the NASDAQ is the S&P 500 (CME:SP500), which is up 3.62% as of midday Eastern Standard Time. The DOW (INDEX:DJI), not to be out done, reversed its earlier weakness and rallied into positive territory for the month and is presently up 3.12%. Continue reading "The Beat Goes On – August Recap"