The Gold Report: Jocelyn, I'm looking at a portfolio of junior precious metals mining stocks, and all I can see is red ink. With the exception of MAG Silver Corp. (MAG:TSX; MVG:NYSE), all in that group are underwater for the past 52 weeks. We are currently in a down-trending precious metals market, and I'm interested to know if catalysts matter anymore.

Jocelyn August: Catalysts absolutely do matter right now. We may see a catalyst occur in a company followed by a 2% uptick in its stock, on the same day the sector as a whole may be down 25%. We may see that even in this price environment. If you were aware of that catalyst and you bet on it, you would actually have fared better than the sector on that day. By comparison it actually did help the stock price.

"Catalysts absolutely do matter right now."

Conversely, we also see a fair amount of catalysts that might have a negative consequence to the stock price, particularly when it comes to permit approval decisions that may go the wrong way for the company. You could get pretty badly burned. For example, back in early October 2012, Pacific Booker Minerals Inc. (BKM:TSX.V; PBM:NYSE.A) announced that the environmental assessment permit for its Morrison project in central British Columbia was denied. The stock dropped 66% in one day and then dropped even further in the week. A month after that event, Pacific Booker was down 75% from the day before the announcement. So, catalysts do matter.

TGR: In this kind of depressed gold and silver market, it appears that the effect of negative news is magnified. Is that in fact the case? Continue reading "Value Market in Gold Will Work for Patient Investors: Jocelyn August" →

Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your mid-day market update for Friday, the 1st of March.

Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your mid-day market update for Friday, the 1st of March.

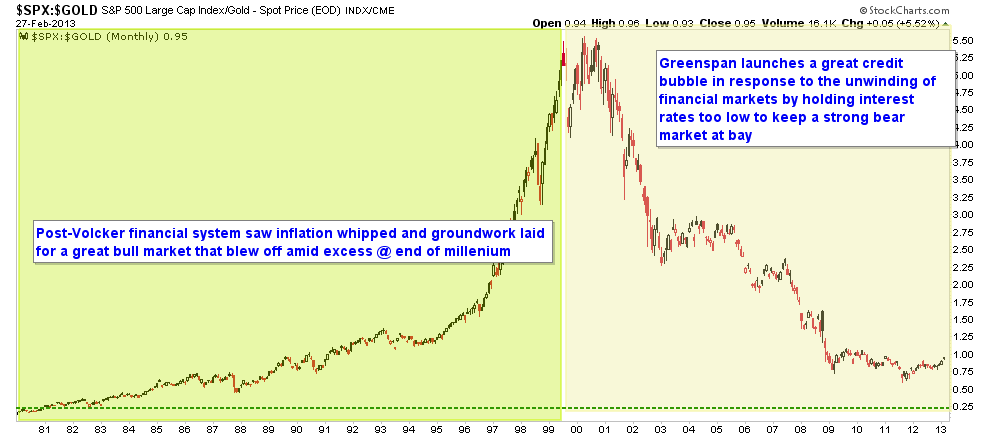

S&P 500 – Gold ratio monthly chart

S&P 500 – Gold ratio monthly chart