Silver (FOREX:XAGUSDO) hit the previous low set in October at the end of last week in line with my expectations posted earlier. It undoubtedly affects the silver mining companies’ stocks, and in this post, I would like to update their performance for you.

The top silver mining stocks filtered last time by ROE are SSR Mining Inc. (NASDAQ:SSRM) (former ticker SSRI), Coeur Mining Inc. (NYSE:CDE) and Pan American Silver Corp. (NASDAQ:PAAS).

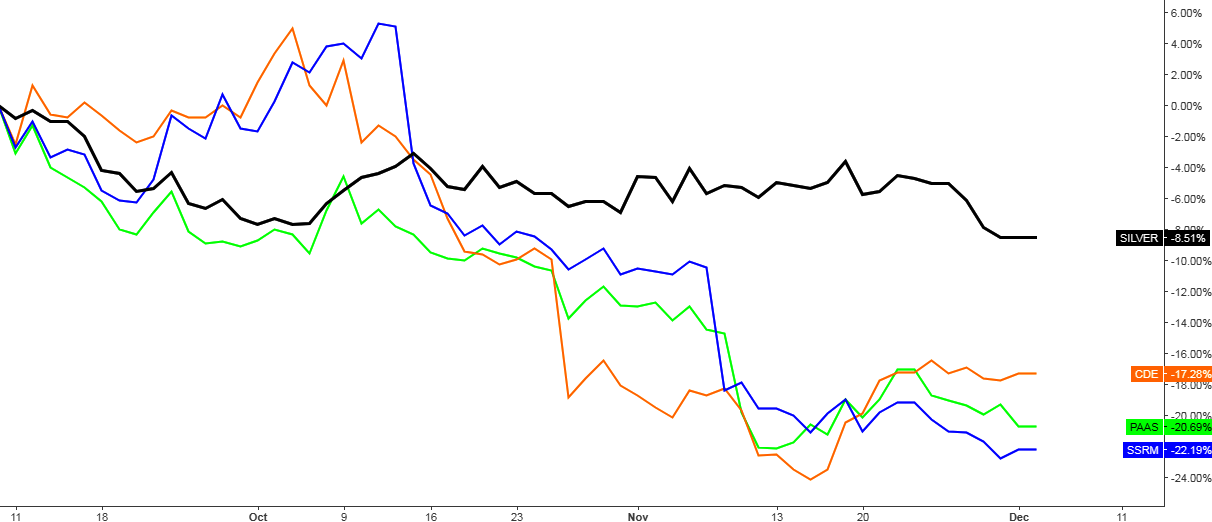

Chart 1. Top Silver Stocks By ROE Vs. Silver: No Winners

Chart courtesy of tradingview.com

The chart above begins on the 8th of September, 2017 when silver shaped the peak and started to drop. For the past three months, there are no winners here. Silver (black) lost the least, but still a significant -8.5% for this short period. If you read my earlier post about the top gold stocks’ performance you found that there was at least one stock (Golden Star (GSS)) with the positive dynamics.

Both CDE (orange) and SSRM (blue) didn’t follow silver’s drop right away making higher highs one after another, and only after silver shaped the correction and started to dive again, these stocks began to collapse. Coeur Mining lost -17% and SSR Mining bled the most among three stocks with -22%. Pan American Silver (green) was moving hand in hand with silver, but then heavily diverged to the downside to finish in second place with a loss of almost -21%.

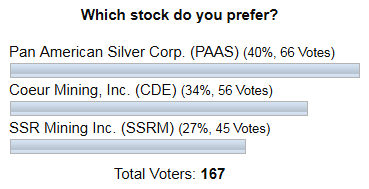

Below are your voting results for these stocks from the previous post.

Chart 2. Previous vote results

As you can see, you guys correctly picked the top loser SSRM. PAAS is not the leader in today’s competition, but it had the best overall fundamentals, and it was the only name to get the price gain. Therefore, I wasn’t surprised with voting results. Coeur Mining is among the regular favorites and sometimes like in this post, it pleases its fans with the best performance.

Both SSRM and CDE advanced very well after the previous post but not enough to break above the confirmation resistances as silver was falling from above the $17 handle to above the $16 mark for almost one dollar and that wasn’t supportive for the stocks. They just crashed and hit invalidation points last month. Chances remain low for the reverse to the upside as silver broke below the trough established in October.

This time I would like to share with you the chart with an analysis of your favorite Pan American Silver.

Chart 3. Pan American Silver (PAAS) Weekly: Last Support Left

Chart courtesy of tradingview.com

Last week silver broke below the consolidation support highlighted in the chart in my previous Gold & Silver post.

As you could see in the chart above, Pan American Silver was even earlier than silver to break below the black support. The stock already finished the pullback to the broken trendline and continued to the downside. I spotted such a price action many times before in my charts for you to show how strong moves develop doesn’t matter to the upside or downside. Every time the breakout occurs, it should be followed by the pullback to the broken trendline. This makes the action more reliable.

There is one last hope for the bulls left on the downside at the $13.80 mark where the consolidation low has been established last November. Below it there could be an “abyss” before the major support at the $5.38 level would catch the stock price. I added two notches of Fibonacci retracement levels to ease the orientation in this “open space.” The 61.8% level corresponds to the $11.57 mark, and the 78.6% level is at the $8.85 mark.

The invalidation point is further and further in the rearview mirror at the distant $19.56 level (the top of the second leg of consolidation).

Silver doesn’t give any chance now for the silver miners, and it could take some time before we would see some bullish alerts on the chart. We should wait for the patterns signaling about the upcoming reversal supported by the accumulated bullish divergence on the RSI. Let’s live and see.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.