With oil prices having staged a recovery during the first quarter of 2019, primarily due to the withholding of oil supplies from Saudi Arabia, President Trump has once again entered the oil market as a threat. Not since OPEC’s founding in 1960 has an American president been as vocal or involved as Trump.

Trump’s intervention in “Round 1,” summarized below, shocked the market, causing a massive price collapse. However, with close scrutiny of the president’s views, both before taking office and over the past year, the market should not have been so surprised.

Saudi Arabia is in a delicate position. On the one hand, it needs oil prices in the $80s to support it's country’s budget, even if lifting costs are $10 or less. It also knows that a “high price” is not the best price longer-term, due to cutbacks in demand and the increasing availability of substitutes, such as U.S. shale.

But possibly most importantly, it depends on the U.S. for its security. And looking forward, it wants U.S. investment to help diversify its economy as the oil age wanes.

Simply put, it cannot afford to ignore this U.S. president, whose first international trip was to KSA. There is an important political and economic link to the U.S. that it did not have even one president ago (Obama). And its arch-nemesis, Iran, at the same time is being severely harassed by President Trump.

It can’t get much better for Saudi Arabia. But it could get a whole lot worse if they insist upon having it their way.

Round 1 End Game

For long-only, long-term oil & gas investors, 2018 turned out to be a brutal year. They complain about being sucker-punched by President Trump’s granting of waivers to buy oil from Iran after he got Saudi Arabia and friends to pump-up their output before sanctions went into effect.

UAE Energy Minister Suhail bin Mohammed al-Mazroui, the OPEC president, said, back in May, OPEC has an adequate "buffer" of potential output to cushion oil markets if the U.S. re-imposes sanctions on Iran. "Don't worry about supply," he told reporters when asked about potential impacts on crude supplies.

And Trump had both waivers and the Strategic Petroleum Reserve to draw upon as policy options. There was no way to my mind that he would cause oil prices to spike right before the mid-term elections in early November sanctions went into effect.

The market was primed to climb to $100/b or more due to a collective investor confirmation bias that did not materialize.

Round 2 End-Game

The Saudi kingdom slashed its production to a four-year low of 9.82 million barrels a day in March, according to a Bloomberg survey of officials, analysts and ship-tracking data. Output from the 14 members of the Organization of Petroleum Exporting Countries fell by 295,000 barrels a day to 30.385 million.

According to Saud Energy Minister Khalid al-Falih, KSA will not drop to 8 million barrels per day. At the December OPEC meeting press conference, Saudi Energy Minister Khalid A. Al-Falih stated that “Our guiding principle is we will keep the market well-supplied.”

Source: OPEC

Mr. Al-Falih later stated to the press:

“Even with US growing at fantastic numbers over the last couple of years certainly in 2018 and 2017, we’ve been able to grow. Look at Russian production, it has grown. Not too long ago, three or four years ago, Saudi production was in the low nines. And we thought we were going to be stuck in that neighborhood for a long, long time. And here we are today talking about climbing down from 11.1 to 10.3….If we find out that we're having to cut unreasonably, then that’s when we'll say we can’t do it anymore. So if you told me today that you have to go back to 8 million to balance the market, Saudi Arabia, I would tell you no. That is a structural change that Saudi Arabia will not do. We will not cut to allow shale to grow 2 -3 million year after year after year. That is a structural change Saudi Arabia cannot do.”

U.S. Policy tools

If the Saudis do not let-up on their production cuts, the U.S. could apply even greater pressure on the oil market.

The NOPEC legislation – No Oil Producing and Exporting Cartels Act – in the U.S. Congress is progressing. The House Judiciary Committee approved the bill, and it will be considered by the full House. There is bipartisan support.

President Trump has called OPEC a “total illegal monopoly.” And last June he stated, “…you have a monopoly called OPEC, and I don't like that monopoly." In September, he told world leaders at the UN General Assembly that OPEC was “ripping them off.” There is little doubt in my mind that he would sign the bill if it comes to his desk.

Mandated SPR Sales of 288 Million Barrels

The U.S. could also accelerate the drawdown of oil from the Strategic Petroleum Reserve that has already been mandated by Congress.

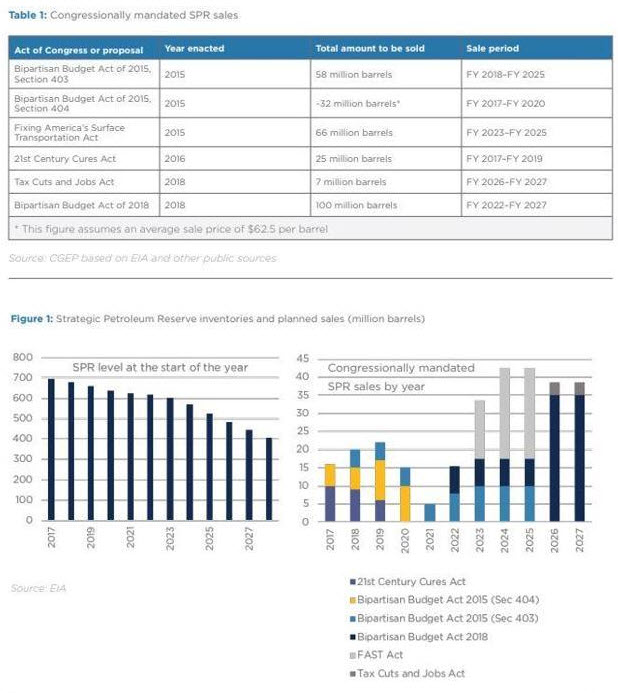

Since 2015, the U.S. Congress has enacted five pieces of legislation that mandated oil sales from the SPR. The sales were primarily motivated by a desire for revenue to pass legislation unrelated to energy. These authorized sales totaling about 288 million barrels will reduce the size of the SPR to just below 410 million barrels by the end of 2027 from 695 million barrels at the beginning of 2017. Note that this is a drawdown, not an exchange where the barrels would be replaced.

Source: Columbia SIPA, Center on Global Energy Policy

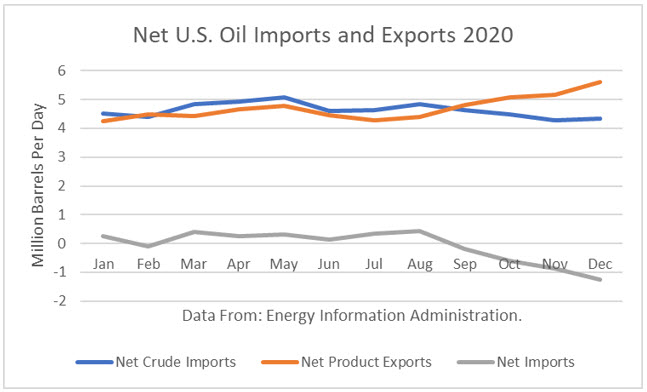

Reducing the size of the SPR has made sense due to changes over the decades since 1975 when it was first authorized following the 1973-74 Arab Oil Embargo. It was designed to help offset disruptions to oil imports, and the International Energy Agency established a 90-day requirement for import protection. The SPR size is calculated by multiplying the Energy Information Administration's reported net petroleum imports per day by 90.

At the current level of 660 million barrels, the SPR holds the equivalent of 190 days of import protection based on net petroleum imports over the past 52 weeks of 3.469 million barrels per day. The 90-day requirement translates to an SPR requirement of just 312 million barrels, and part of the requirement may be met by private (industry) stocks.

In 2020, the Energy Information Administration predicts that the U.S. will flip from being a net oil importer to a net oil exporter of 68,000 b/d.

Trump could make the case to Congress to draw down the 410 million barrels by 500,000 b/d to achieve the mandated goal earlier by the end of 2021.

Conclusions

In the final analysis, KSA is subservient to the US for its security and economic development. It is not going to defy Trump. It has clearly stated its goals and oil prices appear to be near or at the top of Trump’s comfort zone to preserve economic growth.

President Trump is far and away the most activist U.S. president in the oil market since the oil cartel came into existence in 1960. His views about OPEC have been recorded for years.

In the unlikely scenario, Trump is ignored, the easiest way for him to affect long-term oil market psychology is to announce he will sign the NOPEC legislation. KSA will still be permitted to raise and drop its production, but it would have to be done independently, as it is now in reality.

Or he could announce a “speed-up” in the mandated SPR draw. That is good for about 500,000 b/d of additional supply through 2021.

The Saudi Energy Minister would be ill-advised to mess with Trump.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.