The Global Outlook: Platinum Is In Serious Trouble

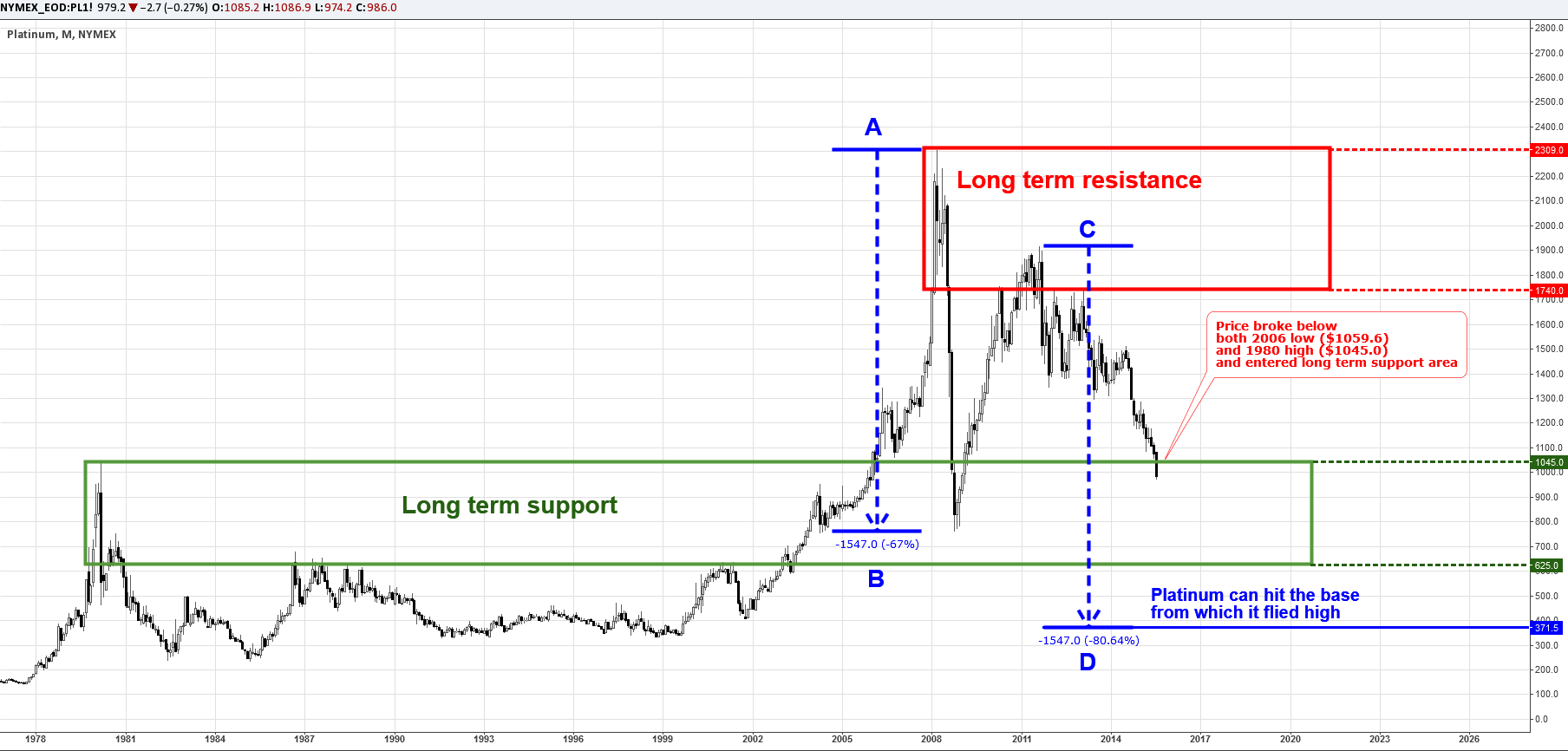

Chart courtesy of TradingView.com

Indeed, this metal is very tricky. One moment it can be flying high, then it can take a swing hitting the bottom and again and again. This time around, Platinum is on its way down, falling like a hot knife through butter. Without any problems, it has lost $500, down from $1500.

The minor swing was detected at the $1200-$1300 level on the monthly charts and then the metal slid even faster. The price has easily broken below both the 2006 low at $1059.60 and the 1980 high at $1045. The psychologically important round number level at $1000 has fallen even quicker. Continue reading "Platinum Could Hit The Floor"