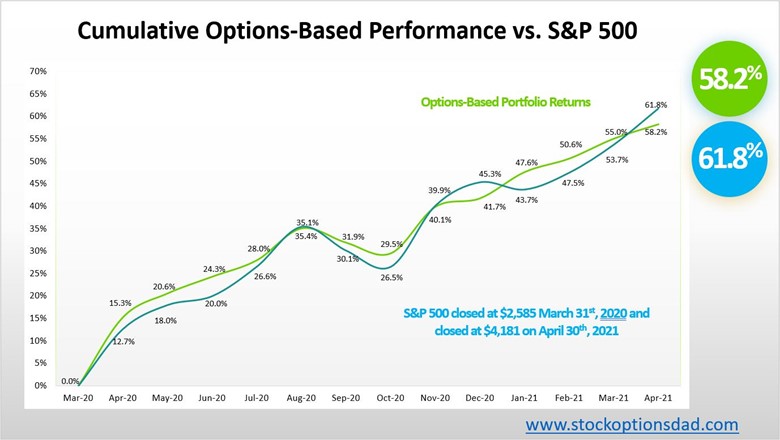

Controlling portfolio volatility and reducing overall market risk while generating superior returns relative to the broader market can be achieved with options. Essential to this strategy is a blended options-based approach where 50% cash is held in conjunction with long index-based equities and an options component. Another critical element is setting the probability of success in your favor and leveraging time decay of options via Delta and Theta, respectively.

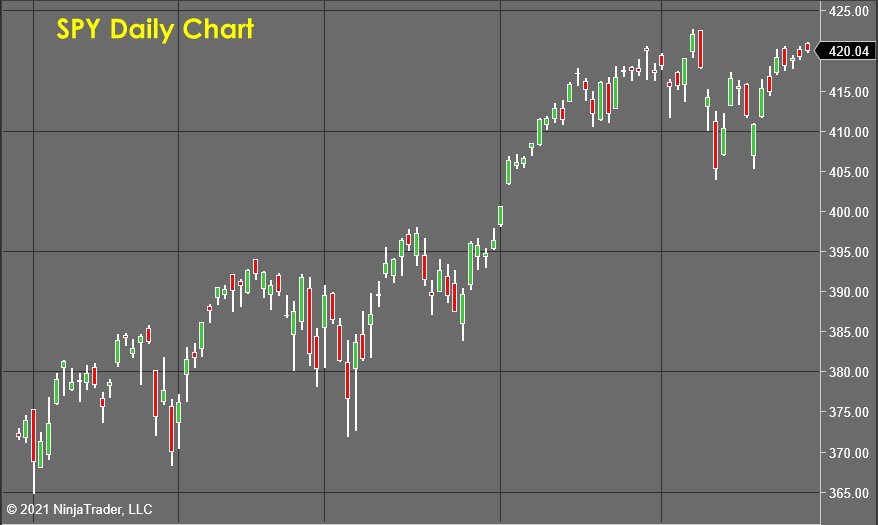

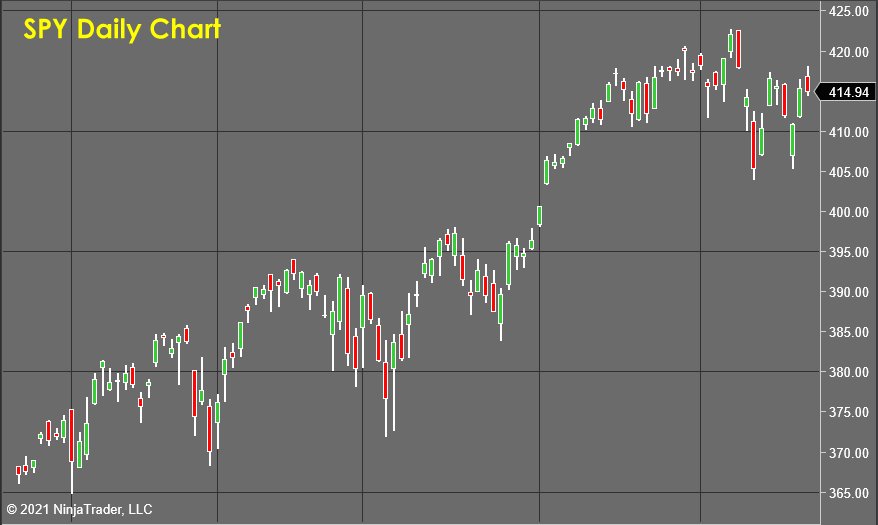

Acting with skill and caution over ~280 trades and ~13 months, generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital has been the core of this options-based/beta-controlled portfolio strategy. Options allow one to generate consistent monthly income in a high probability manner in various market scenarios. Options win rate of 98% was achieved with an average ROI per winning trade of 8.0% and an overall option premium capture of 85% while outperforming the S&P 500. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk via a beta-controlled manner. The options-based approach circumvented September 2020, October 2020, and January 2021 sell-offs while outperforming/matching the S&P 500 over the 13-months (Figures 2-5).

Delta

Delta serves as a proxy for the probability of success at the expiration of the option contract. Thus, this value is an absolute number; thus, a negative (put side of the option chain) or positive (call side of the option chain) value is irrelevant. The interpretation of Delta is based on 1.0 less the Delta at a given strike. If the Delta is -0.14 on the put side, this translates into 1.0 - (-0.14) = 0.86; thus, a ~86% probability of the trade expires above the strike or is worthless at expiration. If the Delta is 0.20 on the call side, then this translates into 1.0 - 0.20 = 0.80, thus ~80% probability of the expiring below the strike or being worthless at expiration. Selling options near a specific Delta that is out-of-the-money places the statistical edge in your favor. Given enough trade occurrences, the probabilities will play out to reach their expected outcome. Thus, trading at a Delta of 0.15 will yield a winning trade success rate of ~85% if all trades go to expiration (Figure 1). Continue reading "Delta And Theta: Probability And Time Decay" →