Hello traders everywhere. The Monday morning market rally in the U.S. market faded as we entered afternoon trading with evaporating tech gains leading the way which leaves the Nasdaq on track for its the worst monthly loss in ten years. The NASDAQ had been up as much as 1.7% on the day before Netflix (NFLX), and Amazon (AMZN) collapsed, both falling over 3% on the day.

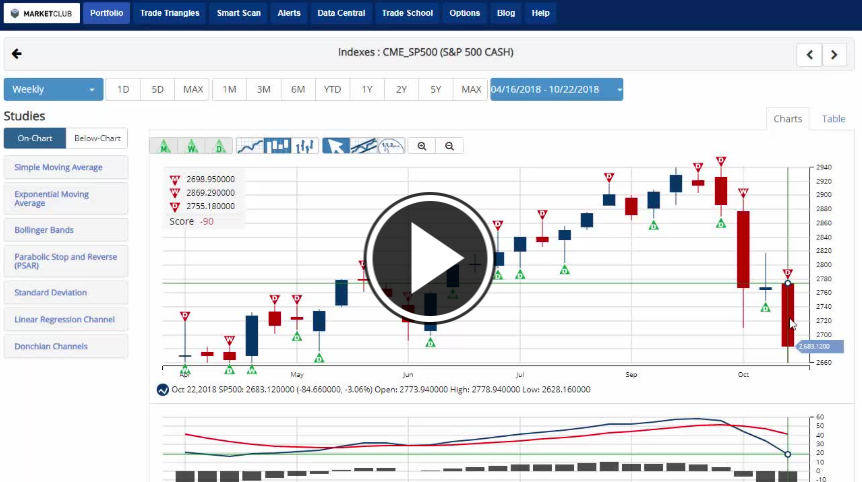

However, the S&P 500 and DOW are back in positive territory for the year, if only just and albeit off their session highs. Although the stock market is in positive territory, for the most part, the S&P 500 hasn't had back to back daily gains all month, and that's been rare for the DOW.

If this Monday morning market rally can make it to the end of the day will it continue into tomorrow? Or will the pattern repeat?