Hello traders everywhere. We were due for a rebound off the lows this week, and that's just what we got on Friday at the open with the stock market posting gains over 1% at the highs across the board with technology and other high-growth stocks leading a fight back. While today's gains are an excellent way to end the week if they hold, we need to remember that overall all three indexes are still down over 4%, that marks the third biggest weekly loss this year.

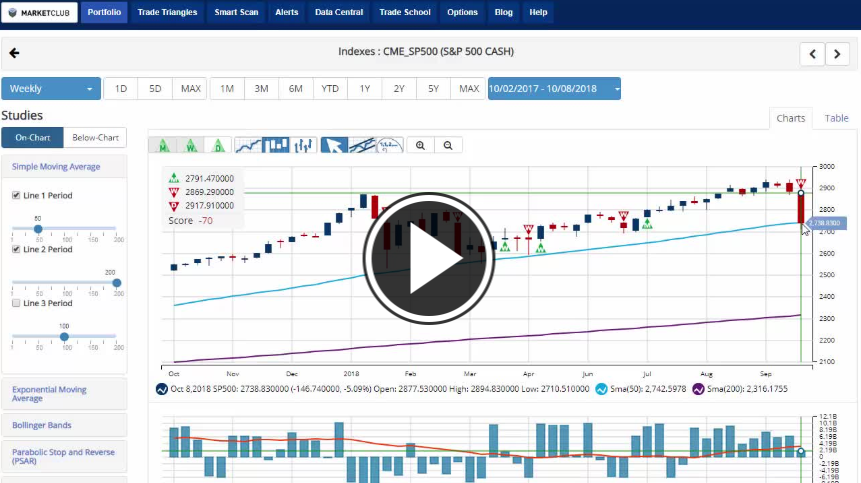

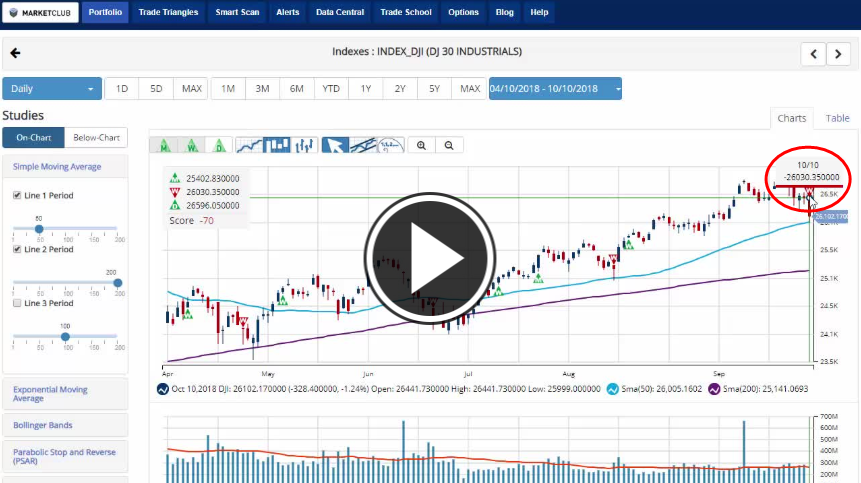

The NASDAQ lost over 4.8% on the week and issuing a new red monthly Trade Triangle at 7,443.10 signaling a possible long-term short position, but surprisingly it hasn't lost the most this week. That honor belongs to the DOW which stands to lose over 5%, issuing a red weekly Trade Triangle signaling a move to the sidelines. There is still quite a bot of room to go before a red monthly Trade Triangle would appear. The S&P 500 is down 4.9%, and much like the DOW issued a new red weekly Trade Triangle signaling a move to the sidelines. Continue reading "Stocks Fight Back After Two Day Slump"