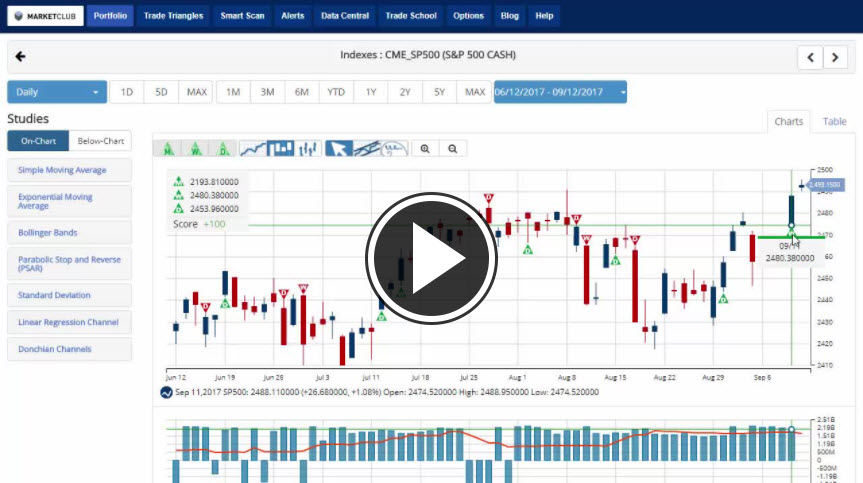

Hello Traders everywhere. Wall Street has extended its record setting gains into Monday. The gains today come on the heels of a record close last week where we saw the all three indexes close at record highs. The U.S. Dollar halted a two-day drop and Treasuries slipped as investors remain bullish on the American economy ahead of the Federal Reserve's policy meeting this week.

The markets focus now turns to the Fed meeting this week. While the central bank is widely expected to keep the benchmark rate unchanged, close attention will be paid to the chance of an increase later in the year and on whether officials will announce the start of a reduction in the bank’s $4.5 trillion balance sheet.

If you haven't read it yet, check out INO Contributor George Yacik's latest blog post where he shares his view on the coming Fed meeting.

Key levels to watch next week: Continue reading "Stock Market Trades At Record Highs"