We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Gold Futures

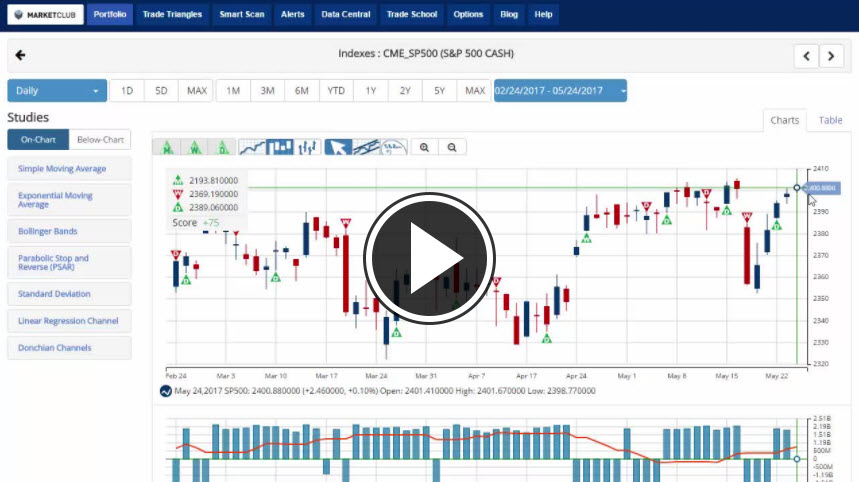

Gold futures in the June contract are trading higher by $10 this Friday afternoon after settling last Friday at 1,253 while currently trading at 1,267 up about $14 for the trading week and hitting a four-week high. Gold is trading above its 20 and 100-day moving average telling you that the short-term trend is to the upside as a weaker U.S dollar coupled with a terrorist attack this week helped propel prices higher. The next major level of resistance is at 1,275 & if that is broken, I would have to think that prices will retest the April 17th high of 1,297 as this is one of the only few bullish trends out of the commodity sectors. I am not involved in this market at present as the chart structure remains poor. The U.S dollar is right near a seven-month low as that has certainly helped gold prices come off recent lows as that trend seems to be strong to the downside. The stock market hit all-time highs once again in Thursday's trade having very little effect on gold prices as money flows seem to be going into both sectors which is very unusual, but can happen periodically with investors being interested in both sectors. In my opinion, I still believe gold prices are limited to the upside as all the excitement is in the equity markets, but there are so many problems worldwide right now that prices are supported in the short term.

TREND: HIGHER

CHART STRUCTURE: POOR - CHOPPY

Continue reading "Weekly Futures Recap With Mike Seery"