Are you one of the millions getting hit with snow on the east coast?

What a great time to sit down, review your investment strategy and take advantage of the snow day.

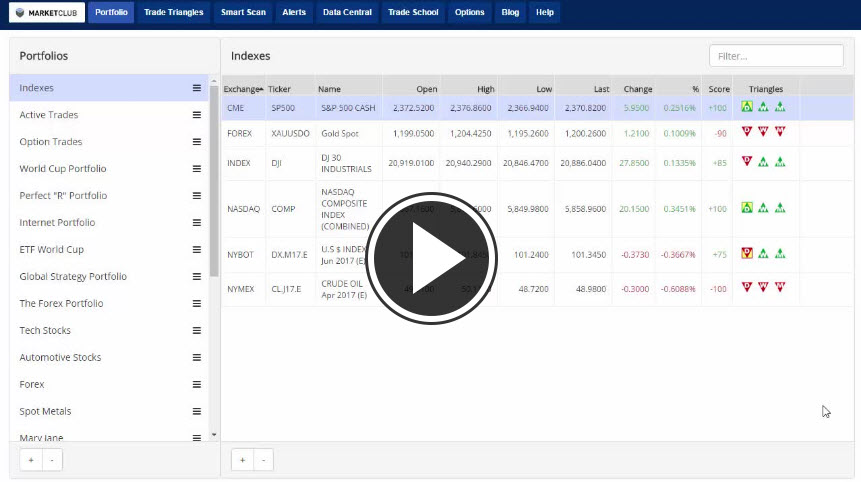

Are you missing out on a strong trending stock or ETF? Are the stocks in your portfolio signaling a reverse?

With promo code 1DOLLAR you can use MarketClub's tools to quickly review your portfolio, find new trades, and see real entry and exit signals on over 320K stock, futures, ETF and forex symbols. All for only $1 for your first month!

With this special offer, you'll have instant access to some of the best, un-biased trading tools on the web:

- Trade Triangle entry and exit signals

- Smart Scan market scanning tools

- Customizable charts and alerts

- Portfolio Manager

- And more...

Click here to learn more.

Enter promo code 1DOLLAR on the MarketClub signup page and click "Apply" to instantly see your membership discount.

Act fast, the promo code is only valid until tomorrow evening!

Every Success,

The MarketClub Team

1-800-538-7424 |

su*****@in*.com