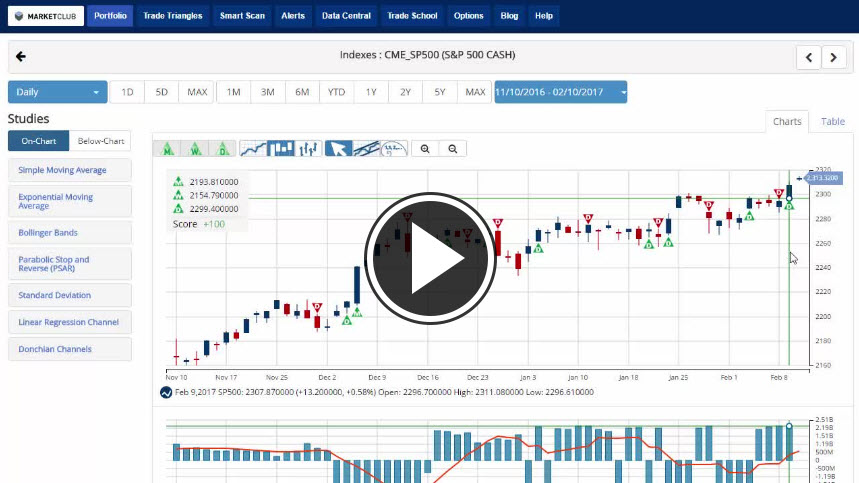

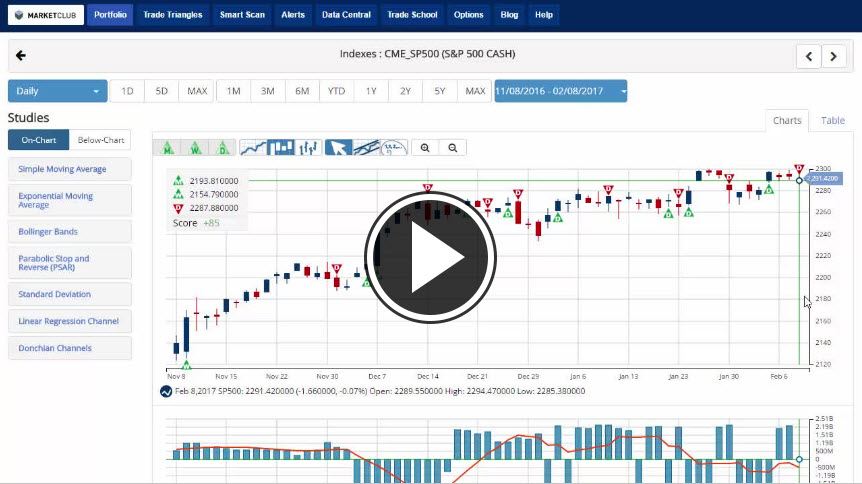

Hello MarketClub members everywhere. By saying the words "Phenomenal tax plan" on Thursday, President Trump jump-started the "Trump Trade" as markets resumed their assault on record highs. President Trump also said in a meeting with the airlines on Thursday that "lowering the overall tax burden on American business is big league... that's coming along very well," adding that an announcement would come over the next two or three weeks. Stocks have climbed to record highs following these remarks.

But that begs the question, who was really trading yesterday? With the massive snowstorm in the northeast the trading volume was lower than average and it seems that the trading computers were the ones pushing the market higher. Scary to think about right?

Key levels to watch next week: Continue reading "The Trump Trade Pushes Stocks To New Records"