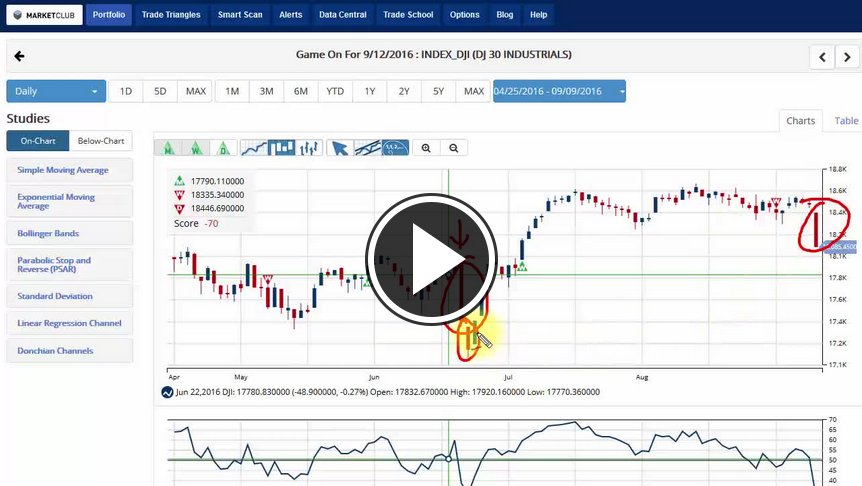

Hello MarketClub members everywhere. Choppy, choppy, choppy that's the only way to describe the recent market action as the Bears and the Bulls battle each other for domination. It reminds you of the election and the fight between the Democrats and the Republicans. Eventually, there will be a direction and a trend both politically and financially. My job here at MarketClub is to help you determine that trend and get on the right side – I am of course referring to the financial markets and not the politics of today.

Indexes: All of the major indices still have their long-term monthly Trade Triangles intact. The intermediate trend based on the weekly Trade Triangles is down which is reflecting the choppy action that we have seen the last few days. What is interesting is if you look at the weekly charts and the weekly RSI you can see that all of the indices are above the 50 support line indicating that the trend is likely to resume to the upside. However, there are no guarantees and I will rely on the weekly Trade Triangles to tell me when to get back on the long side of the market again. Continue reading "The Battle Continues Between The Bulls And The Bears"