We’ve asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

We’ve asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Cotton Futures-- Cotton futures for the December contract was down sharply this week settling at 83.11 last Friday down over 375 points this week in New York continuing its bearish momentum after breaking down at 82 last week currently trading at 79.30 basically unchanged this Friday afternoon. Prices are still trading below their 20 and 100 day moving average hitting a 9 month low & I’m still recommending a short position placing your stop above the 10 day high which at the time was about a $1200 risk but at today’s current price is around $2,500 remembering cotton is a very large contract. In my opinion it looks that cotton prices will retest the 78 level possibly even heading lower as there is weakening demand & excellent crops around the world pushing up supplies at this time despite the fact that the U.S dollar hit a 1 1/2 year low having very little effect on cotton prices at this time. The USDA will come out with crop estimates next week and it’s been quite some time for fresh news to appear due to the government shutdown and that should guide short-term price direction. TREND: LOWER –CHART STRUCTURE: EXCELLENT Continue reading "Weekly Futures Recap w/Mike Seery"

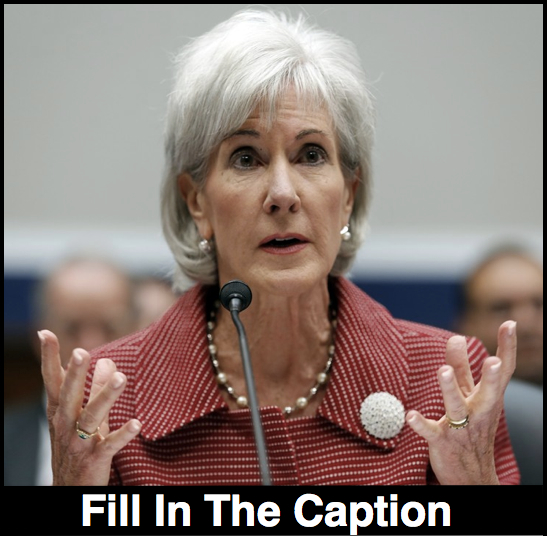

Leave a comment on what you think would be the "perfect caption" for this photograph of Kathleen Sebelius who was sworn in as the 21st Secretary of the Department of Health and Human Services (HHS) on April 28, 2009. Since taking office, Secretary Sebelius has led ambitious efforts to improve America’s healthcare. Here's my caption,

Leave a comment on what you think would be the "perfect caption" for this photograph of Kathleen Sebelius who was sworn in as the 21st Secretary of the Department of Health and Human Services (HHS) on April 28, 2009. Since taking office, Secretary Sebelius has led ambitious efforts to improve America’s healthcare. Here's my caption,