Analysis originally distributed on March 14, 2018 By: Michael Vodicka of Cannabis Stock Trades

Cannabis beverages are quickly emerging as one of the fastest growing cannabis sub-industries.

For proof - look no further than Canopy Growth Corp (TWMJF), Canada's largest cannabis company.

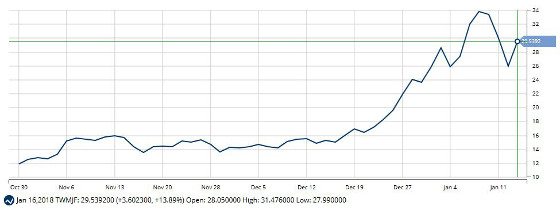

Back in October, Canopy announced a groundbreaking $200 million investment from Constellation Brands (CONST), the third largest US beer distributor with Corona on the roster.

In the short run, news of the investment sent shares of Canopy soaring - jumping more than 100% in the next 10 weeks.

More importantly - the deal signaled an important shift in the Canadian cannabis industry. Continue reading "Canadian Cannabis Company Betting Big On Beverages"