Do you remember the Internet before Google? We do, because we were there! Yes, it's hard to imagine, but INO.com launched on March 21, 1995. We are 20 years old this month!

20 years may not seem like very long, but when it comes to the Internet, it's monumental. INO.com survived and thrived despite the dot-com bust, 9/11, the 2007 recession and the ever-changing environment of the web. We are very proud!

We could not be where we are without our INO.com visitors and MarketClub Members. Thank you.

In celebration of our 20 years in business, we thought this was the perfect time to cut our MarketClub Membership rates by 20%. You can still try MarketClub for 30 days for only $8.95. Then if you decide to stay, your MarketClub Membership will be 20% off of our standard rate. This offer is only available to new MarketClub Members or users who have not had a membership in the past 90 days.

In celebration of our 20 years in business, we thought this was the perfect time to cut our MarketClub Membership rates by 20%. You can still try MarketClub for 30 days for only $8.95. Then if you decide to stay, your MarketClub Membership will be 20% off of our standard rate. This offer is only available to new MarketClub Members or users who have not had a membership in the past 90 days.

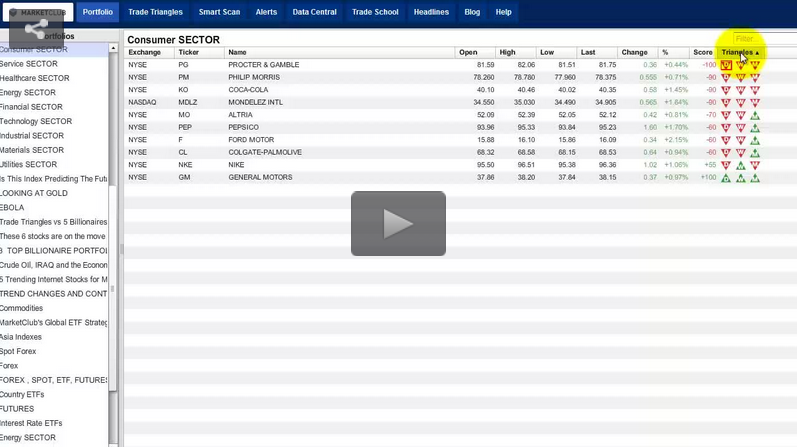

INO.com created MarketClub in 2002 and since then, thousands of traders have been using our trading tools to find opportunities and make decisions with ease. Be your own financial advisor! Because truly, no one cares as much about your money and future as you do.

If you find MarketClub isn't right for you, simply contact us and we can walk away friends. However, if you stay, you'll be getting a great deal!

We're celebrating our birthday the whole month of March, but once the month is done, so is our 20 year, 20% off rate!

Access this 20% off offer!

Thank you again for visiting INO.com and helping us thrive for two decades!

Best,

Adam Hewison & David Maher

Owners of INO.com & Co-creators of MarketClub

su*****@in*.com

1-800-538-7424