The time has come to see if any top currency could rival gold, which established the new all-time-high this year in this traditional yearly post.

Seven currencies represent the fiat money: U.S. dollar (USD) and six components of the U.S. dollar index (DXY) placed by weight: Euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK) and the Swiss franc (CHF). Bitcoin (BITSTAMPUSD) is also here to represent the hyped crypto-world.

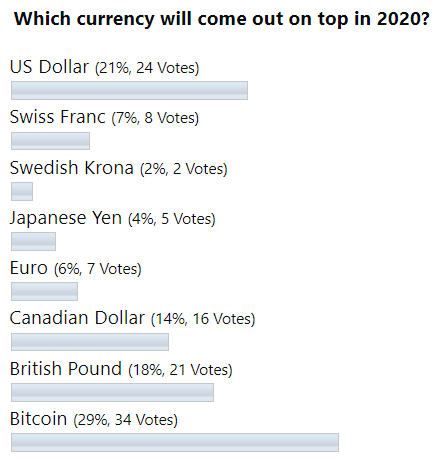

Before we jump to the results of 2020, let us see below how you predicted the future back at the end of December 2019.

The majority of you bet that the "rookie" Bitcoin would beat all others, including the regular favorite U.S. dollar in 2020. The latter was the second choice a year ago. The third pick was interesting as it was the British pound, which was not in the shortlist of your bets before, but it managed to rank #3 last year.

Let us look at the diagram below to find out the results. Continue reading "Top Currencies VS. Gold In 2020: This "Rookie" Rocks!"