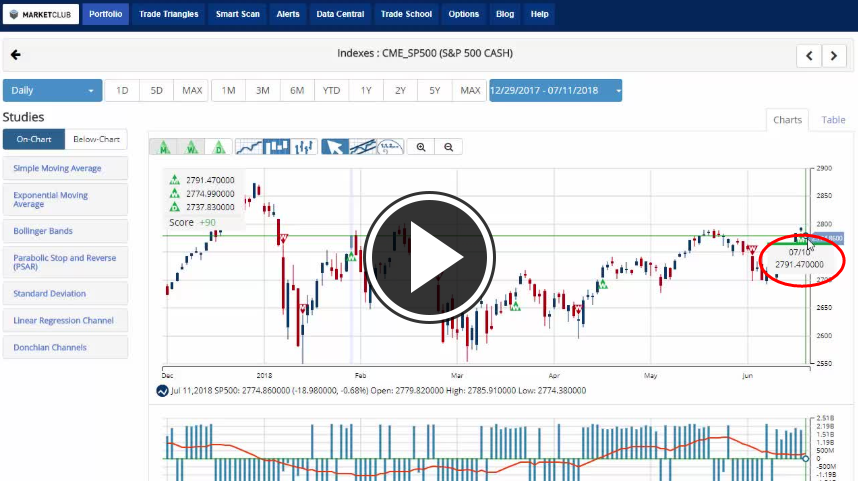

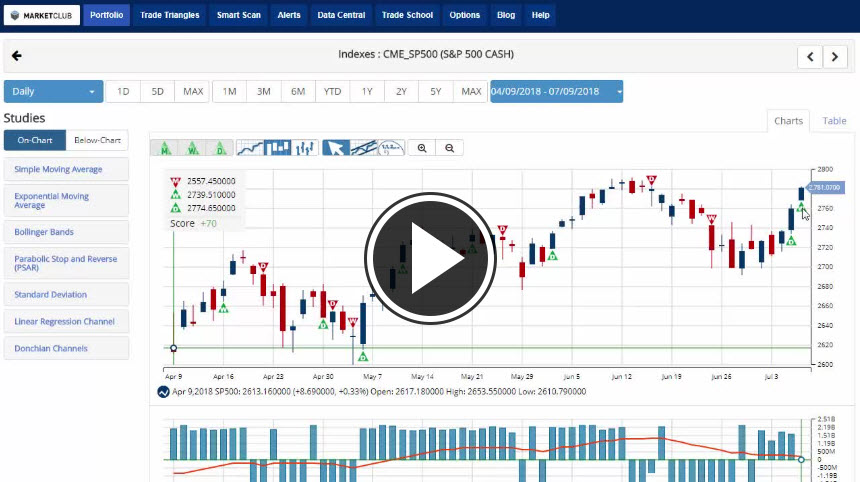

2018 has been a wild year with the bursting of the Bitcoin Bubble, some President Trump induced rallies and declines, trade war fears, North Korean diplomacy and the Facebook data scandal. But most all of, after the stock market rallying for years, its beginning to show signs of sluggishness as the S&P 500 is up a mere 0.84% during the first half of 2018.

But despite the weakness of the overall market, some investors, with the help of a few Exchange Traded Funds have made money during the first half of the year. Let us take a look at the top four, non-leveraged, non-VIX ETF’s during the first half of 2018.

The best performing non-leveraged, non-VIX ETF was the Invesco S&P SmallCap Health Care ETF (PSCH) which rose by 30.62%. Over the last 12 months, PSCH is up more than 45% after climbing an additional 16% during the most recent three months. The fund owns small cap stocks which operate in the healthcare sector and currently more then 75% of the assets are in companies that have a market cap smaller than $2.7 billion. The fund tends to lean towards healthcare equipment companies and healthcare providers more so than drug companies. The averagely weighted market cap is just $2.5 billion. The fund currently has $752 million in assets under management and 74 holdings. The top three holdings are Chemed Corp. (CHE), Haemonetics Corp. (HAE), and Neogen Corp. (NEOG). The funds top ten stocks make up 33% of assets, and it will cost an investor 0.29% to own PSCH on a yearly basis.

An aging population which is living longer than any other generation before it tends to be good for the healthcare industry. While PSCH may not end the year as the top ETF, it is indeed one you could buy now and feel comfortable owning for years to come. Continue reading "Top ETFs For The First Half Of 2018"