No doubt the most dramatic event of the FX market this past week was the ECB decision. Draghi, it seems, has finally "cut the mustard." He delivered a powerful response to the latest softness in Eurozone inflation. Essentially, the ECB expanded its QE program to €80Bln of purchases a month and pushed the deposit rate lower into negative territory. But if you expected these moves to play right into the bears' hands (as it has in times past) you might be in for a surprise.

Eurozone: The Good vs. Bad

When the Euro ended up higher in the aftermath of the ECB decision many were caught off guard. Some claimed the Euro's reprieve was the result of Draghi's rhetoric which suggested no more "bazookas" anytime soon.

But what seems more probable is that Draghi's words might just be the consequence rather than the cause. That is the consequence of some green shots that had started to appear in the latest Eurozone data. Those readings suggested that printing money until the apocalypse was not necessarily needed. That's what we call the "good news."

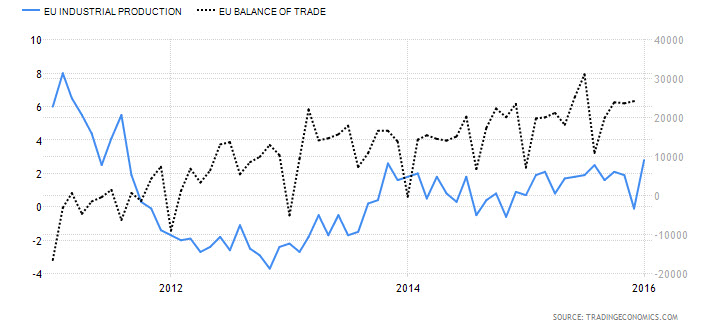

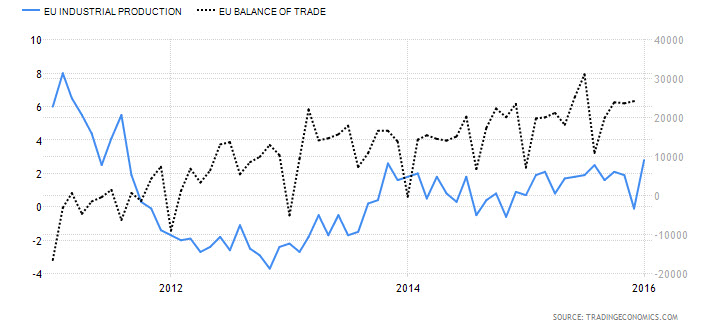

Below are two important indicators for the Eurozone; the balance of trade and industrial production. Both indicators are keenly scrutinized for this export-oriented region.

Chart courtesy of Tradingeconomics

The balance of trade figure has upticked higher and reaffirmed its rising trend from 2012. This suggests that the Eurozone exports more goods than it buys. Continue reading "Euro Out Of The Woods?" →