I pulled some of that Fibonacci voodoo that we do on Apple and if the uptrend support does break around $96, Apple is headed into the lower 80's.

I did a video for CNBC.com and they tore me to shreds in the comments section. The last time I got this kind of reaction was when I said oil is headed towards $26.00 while trading $41 at the time.

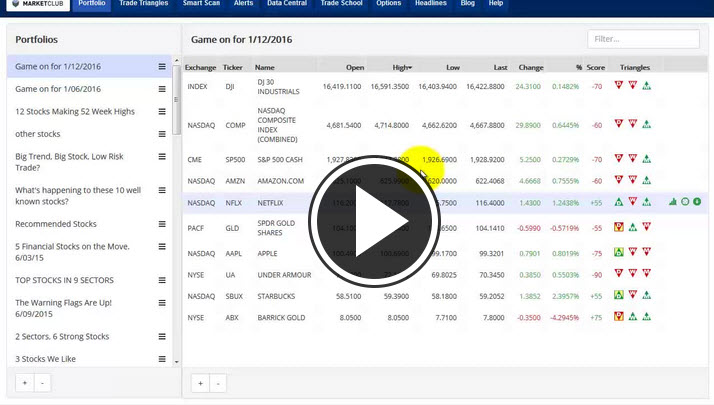

From there we take a look at our options positions in the S&P and AMZN.

Learn more about TradingAnalysis.com here.

Plan Your Trade, and Trade Your Plan,

Todd Gordon