Everyone's bargain list just got a LOT longer. Energy stocks can finally stop feeling so lonely. They have plenty of company now.

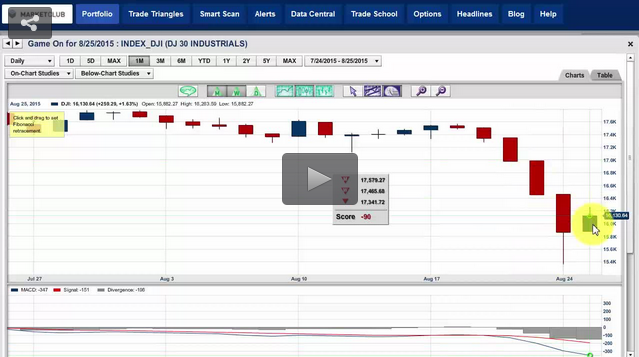

If you've (hopefully) followed Adam Hewison's posts, he illustrated on Monday that it's not yet safe to start acting on your bargain list, as far as stocks are concerned. The broad-market long-term trade triangles are (obviously) flashing red right now, and Fibonacci indicators don't show support for this falling knife until much lower levels.

Adam specifically touched on crude oil in his Tuesday post, saying its RSI is very oversold and flat, and combined with a falling market, one would expect a bottoming out at some point. "Not to say it can't go lower," he added.

So even though your bargain list might be just that – a "watch list" – let's begin looking at whether to even consider energy.

A brief look back

Remember $108 oil, back in the summer of 2014? WTI crude has already traded as low as $38.00 this week, and looks as though it's unlikely to return even to the $60s – in a sustained way – for perhaps many years. In fact, a dip into the $20s seems at least equally likely at this point, given the supply glut combined with the newfound volatility and fear across all markets.

So oil has shed about 65% so far, and has generally held below $60 for all but 14 days since falling below that level 9 months ago. And, of course, oil's plunge has taken the value of most oil companies with it. Feast your eyes: Continue reading "Should Energy Stocks Be On Your Bargain-Hunting List?"