More and more of the world's central banks are moving into negative interest rates and/or Quantitative Easing; the Bank of Japan has a massive ¥80 trillion in QE (per year), the European Central Bank with its estimated €1.1 trillion QE and negative deposit rates, the Swiss National Bank recently moving deep into negative territory, setting interest rates at -0.75% and now the Riksbanken, Sweden's central bank, following suit with interest rates set at -0.1%. And as this process escalates, two words dominate the commentaries: currency war. That word combination, so frequently bandied about by economists, financial analysts and media pundits, embodies the attempt by nations to devalue their currencies in order to increase exports and inflate demand. Yet despite headlines outlining how the currency war between nations can escalate inflation, in almost all major economies, inflation continues to plunge. The question is why? The answer might not only surprise you but put a question mark on the so called "currency war."

US and China Already Stopped "Playing"

One of the biggest facts that economists seem to ignore when warning of a currency war is that the world's two main players, the US and China – the two largest economies and arguably the two which started this so-called "war" – have long been out of the game. The US Federal Reserve Bank halted its massive QE program in October and allowed the US dollar to appreciate since then by more than 14% against the Euro and more than 10% against the Yen. Moreover, the Fed is seen as the only central bank that is seriously considering a rate hike, the total opposite of devaluation. China, meanwhile, perhaps the most aggressive currency manipulator in the world (with the US a close second), has not only stopped devaluating its currency but in fact has allowed its currency to appreciate so much that the Yuan has been the best performing currency in the world after the US dollar. The Yuan appreciated more than 8.5% against the Yen and roughly 12% against the Euro since October.

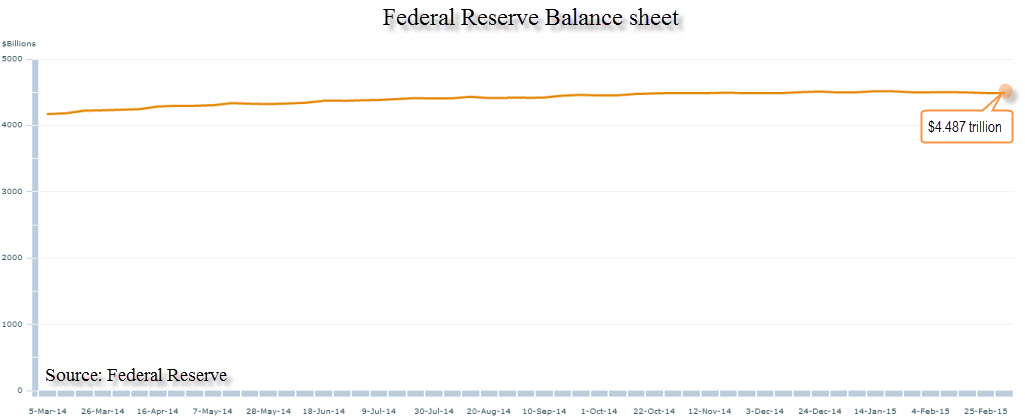

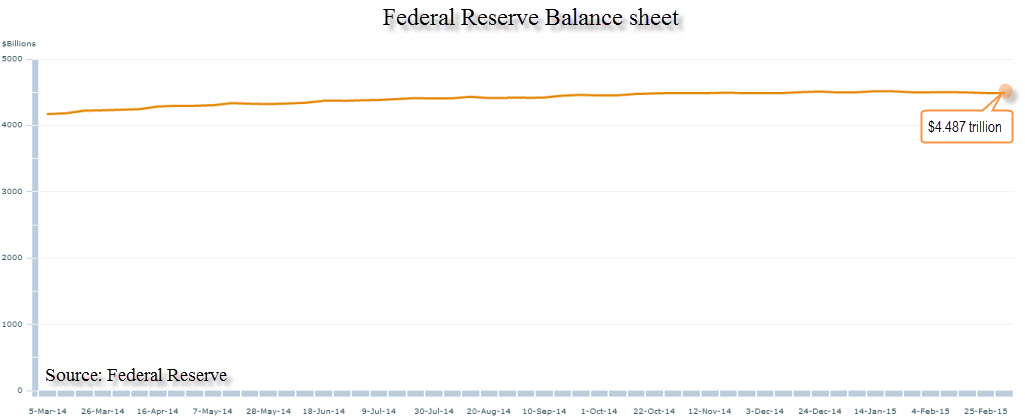

Although both countries aggressively manipulated their currency, their tools were somewhat different. The Federal Reserve used Quantitative Easing, which is essentially ballooning its balance sheet with printed money, a form of currency manipulation by any and all means. The People's Bank of China used to artificially lower the Yuan by purchasing dollars, which of course allowed its foreign reserves to balloon. Those were two very different methodologies, but the outcome was the same: the devaluation of the respective currency. Yet, as seen in the two charts below, China's foreign reserves have plunged by $105.5Bln from its peak and the balance sheet of the Federal Reserve has remained more or less stable, revolving around $4.4 trillion.

Chart courtesy of Tradingeconomics

Chart courtesy of the Federal Reserve

Why the War Ended

While the sense of an escalating currency war is looming in fact this war has aggressively de-escalated. Since 2007, the aggregate amount that the US and China injected into their respective economies amounted to a whopping $6.614 Trillion (not including other PBoC programs), an amount that dwarfs the current liquidity injections of the ECB, the BOJ and all the other central banks. One must wonder what is behind this dramatic change of heart which put an end to currency manipulation by the two biggest players. China, the more aggressive manipulator of the two, made a strategic decision; it no longer wants to be known as the "factory" to the rest of the world but rather it wants to become the world's largest consumer. Thus China allowed its currency to strengthen while lowering interest rates to encourage local consumption. In the US, the case was rather simple; the US has always been a consumer-oriented economy, and while it was hoped that US exports would eventually take the lead, it was actually the return of the American consumer that ended the need for devaluing the US currency.

What Could Trigger Another War?

PBoC Governor Zhou Xiaochuan has reiterated that they see no need to devalue the Yuan. As one might expect, it is inflation, yet again. While inflation in the US is stable in China it's taking a plunge, falling to 0.8% as of late. Although with interest rates at 5.35% the PBoC still has plenty of room to maneuver, one thing is clear and that is if things turn ugly in China and inflation turns into deflation, even after a rate cut, then China might go back to the good old tried and tested method of manipulating the currency. With China experiencing a prolonged deleveraging cycle, this risk exists. But until then, while the headlines may scream currency war, understand that it's a scare tactic. If anything, the currency war has dramatically de-escalated and if things don't deteriorate from here, it could mean that the currency war that everyone is busy screaming about has essentially ended.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The contributor does have an interest in the USD/ILS rising as of the date of publication. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.