October was a spectacular month for stocks, but November may prove to be a different animal with potential roadblocks.

Many professional traders are looking at major resistance from the old highs in May of this year. I believe that the major indices are going to have their work cut out for them to move over these levels in the future.

On November 9th, I talked about Macy's Inc. (NYSE:M) showing what I believed to be major weakness in this stock. Macy's earnings were announced this morning which disappointed the market and pushed it down over 13%. I think this is a testament to MarketClub's Trade Triangle technology and the reassurances and confidence it provides investors.

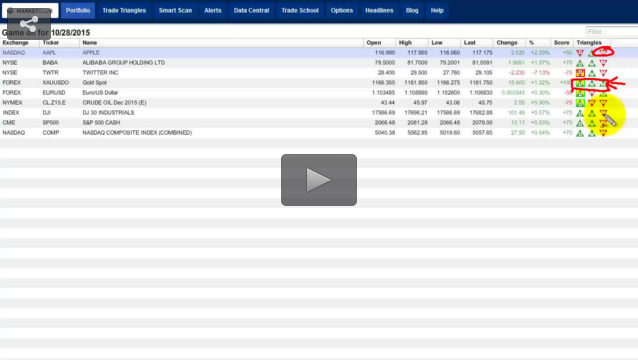

I will also be taking a look at Alibaba Group Holding Limited (NYSE:BABA) that had a record sales day, generating over $10 billion in gross merchandise sales in just over 14 hours. Should you buy Alibaba here or just be on the sidelines?

I'm going to do something a little different today and look at three stocks that I talked about in an earlier video and a MarketClub member asked us to follow up on. The three stocks in question are The Walt Disney Company (NYSE:DIS), Monster Beverage Corp. (NASDAQ:MNST) and News Corporation (NASDAQ:NWSA). I will see where they were trading before earnings and where they are now after earnings.

Also in today's video update I will be looking at gold which is in a very special place right now and definitely should be on your radar screen. In addition to the gold market, I will be looking at the dollar, crude oil and the major indices.

Have a great trading day everyone.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub