Gold is a unique asset class, despite being uninteresting from a volatility investing perspective. I mean, it's currently sideways amid a soaring equity and dollar value, but it is still interesting for selected market participants for its safe haven status and diversification purposes.

We all have different time frames that we use, common investors use daily, weekly and monthly charts and the quarter to year perspective when they summarize the profits or losses. And so do the public companies when filing their earnings reports every quarter. And for these type of investors, Gold's dynamics in recent years have been frustrating as it is has been totally unmoved month by month, making investment unpromising.

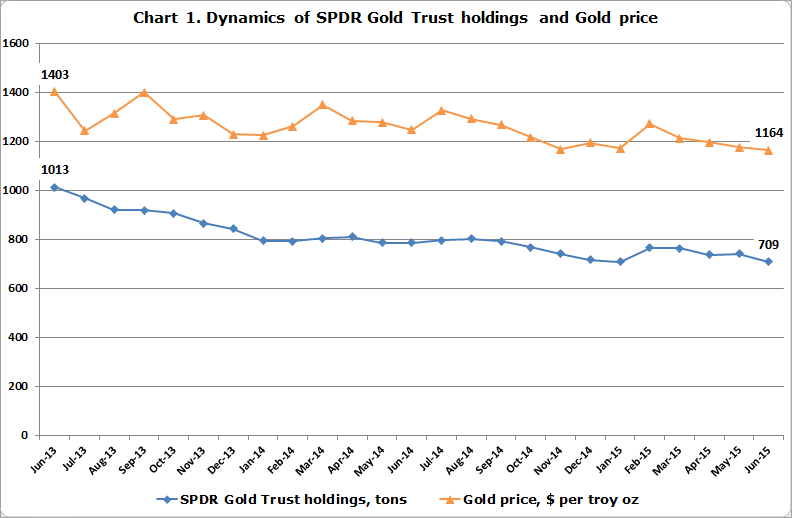

Data courtesy of www.spdrgoldshares.com

On the above monthly chart, tailored especially for INO.com readers, I want you to see for yourselves the direct relationship between Gold prices and the demand for ETF holdings. For 2 years as depicted on the chart, Gold lost 17% of its total value. Meanwhile the SPDR Gold Trust holdings lost 22% of its total value, almost matching dynamics. The holdings fell even more than the Gold price did telling us about worsening investors' sentiment for Gold. Remember the old words that "the Fear has a large shadow". The holdings were falling, gradually neglecting upswings in the Gold price, and only this January did the holdings pick up from 709 to 763 tons amid Gold's price growth from $1172 up to $1273. But this outstanding move proved to be short-lived, and both indicators fell back to the lows.

On the contrary, the central banks are buying Gold despite the sideways market. Continue reading "Central Banks Keep Buying Gold When You Are Not"