INO.com’s free app is available in the App Store® and Google Play!

With this app, take your portfolio on the go with lightning-fast charts and analysis. You’ll have market data for over 350K symbols in your pocket, access to your custom portfolio, and market commentary and analysis from industry experts.

This app is completely free and is ready to download now!

Download Our App Now

App Features

We've only just begun. You can expect even more tools and custom analysis in the future in addition to these features.

Market Pulse

Check the heartbeat of the futures and stock market. See the day’s biggest movers, new momentum signals, and the latest analysis.

Quotes & Data

Price, open, high, low, close, volume, open interest, delivery dates, and more data for over 350K commodity, futures, forex, ETFs, and U.S. and Canadian stock symbols.

Charts

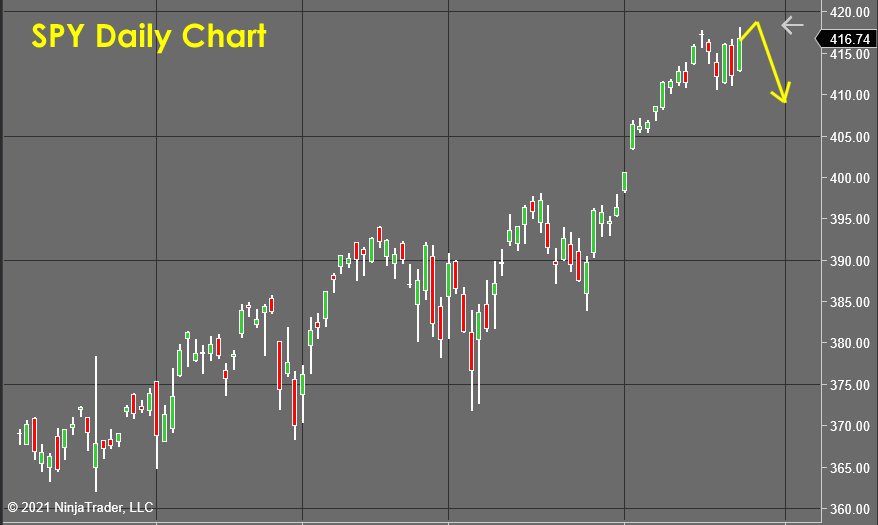

Clean, easy-to-read charts show price action on numerous timeframes.

Portfolio

Create your custom portfolio that syncs with INO.com for access on all devices.

Blog

Access analysis from our financial contributors covering metals, foreign exchange, commodities, options, energies, Fed moves, stocks, and ETFs.

Our Top 10

What contract prices are on the move? Check out Our Top 10, up-to-the-minute rankings of the strongest trending commodity and futures markets.

The days of sitting at a computer monitoring the markets are long gone.

Download INO.com’s app for access to the most important market data whether you’re sitting on the beach or teeing off on the back nine.

Download on App Store

Download on Google Play

Enjoy,

The INO.com Team

su*****@in*.com

Google Play and the Google Play logo are trademarks of Google LLC. App Store is a registered trademark of Apple Inc.