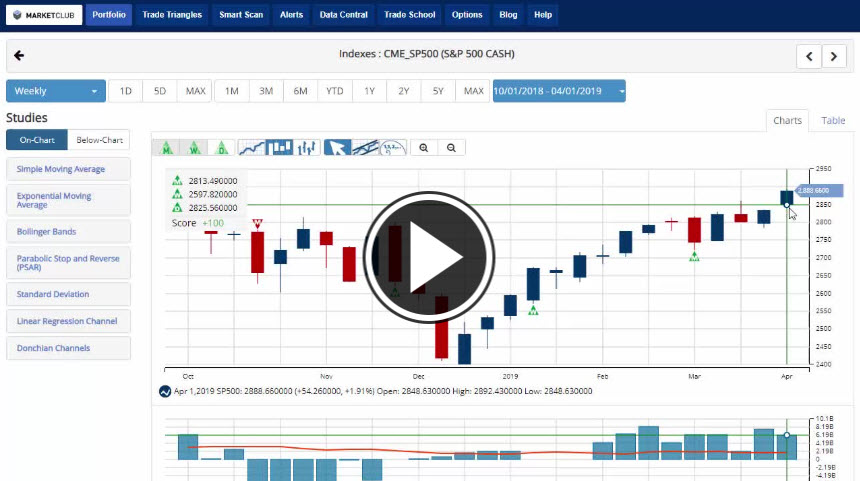

Hello traders everywhere. The Federal Reserve will release the minutes of its March monetary policy meeting this afternoon at 2 PM EDT. Last month, the U.S. central bank decided to maintain interest rates and hold off any further increases this year. The minutes should provide additional details for investors to understand why most Fed officials do not expect to raise interest rates in 2019.

U.S. stocks opened slightly higher Wednesday, steadying following Tuesday's decline as investors weighed data showing moderate inflation and the latest signs of caution from the European Central Bank.

The CEOs of America's biggest banks are appearing before Congress on Wednesday for the first time in 10 years, as they face new scrutiny over their practices and record profits a decade after the financial crisis. Continue reading "Stocks Flat Ahead Of Fed Minutes"