Analysis originally distributed on October 4, 2017 By: Michael Vodicka of Cannabis Stock Trades

Growing revenue by more than 100% for 11 consecutive quarters is no small accomplishment.

A statistic like that immediately tells me two things about a company.

Number one, it is operating in a high-growth industry.

Number two, it is doing a great job of capturing that growth.

These are the reasons I'm excited about the little-known cannabis stock I am going to share today.

This early industry leader just reported its 11th consecutive quarter of at least 100% revenue growth.

That's a pretty ridiculous streak - I haven't seen anything like it even in the high-growth cannabis industry.

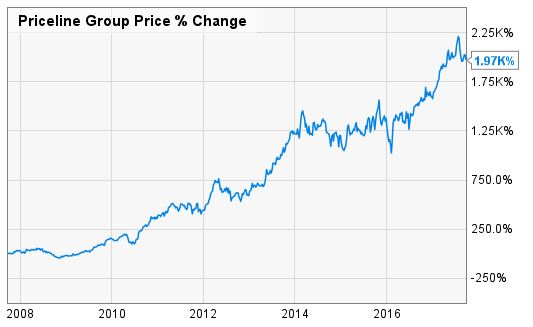

That's why shares are up 104% in 2017 and ready for more.

Let's take a closer look. Continue reading "100% Revenue Growth for 11 Consecutive Quarters"