Hello MarketClub members everywhere. It would appear as though the markets have gone to sleep or have been mesmerized by the summer Olympic Games. I believe going to come to an end in just 10 more days as we officially say goodbye to summer. After Labor Day I expect we will see more volume and more direction in all of the markets.

This time of year reminds me of how the markets behave after the 15th of December when most traders check out for the year. If you have not made your money by 15th of December, the odds are against you making it in the last two weeks of the year. The keyword right now is patience, patience, patience.

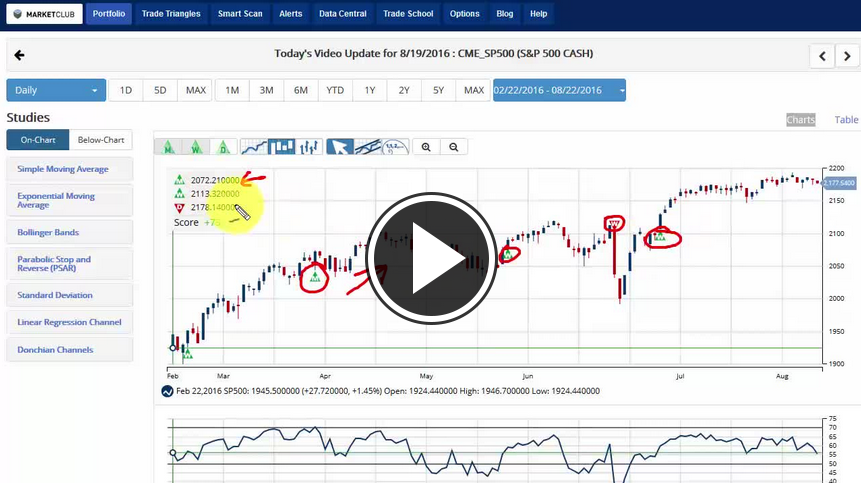

The way to look at the markets when they move into a doldrum period like we are in now is to look at the big trends before we entered into this quiet period as the odds once again favor a resumption of the major trend. It doesn't always work out that way, but if you're betting with the odds, it is the way to go.

Here are the major trends for each of the major markets according to the Trade Triangles. Continue reading "Just 10 More Trading Days"