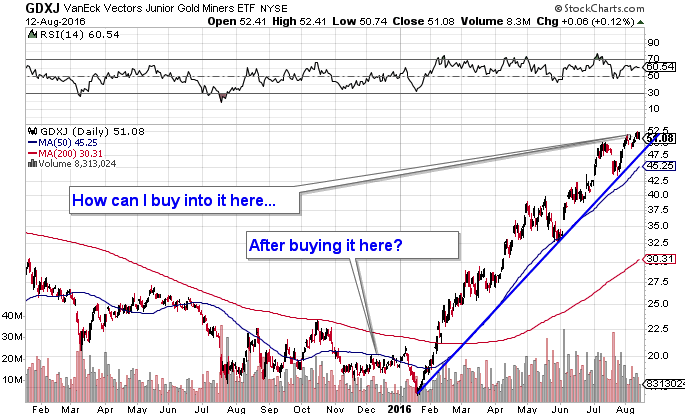

Precious metals expert Michael Ballanger reviews a number of the key elements that have characterized 2016's advance in gold, silver and the associated mining, development and exploration stocks.

With the summer of 2016 passing by at an alarming pace, I think it is important to take a few moments away from the enchanting beauty of Georgian Bay and review a number of the key elements that have characterized 2016's breathtaking advance in gold, silver and the associated mining, development and exploration stocks. While gold bullion is ahead 26.6% year-to-date, the gold mining stocks have demonstrated their incredible contained leverage and why, when the market operates properly, they are vastly more rewarding than the physical metals themselves. However, the 2016 advance has had many analysts questioning the integrity of this latest move as the HUI (NYSE Arca Gold BUGS Index) and the XAU (Philadelphia Gold and Silver Index) have defied gravity, the laws of physics, the Law of Diminishing Returns, and just about every other law that historically pertains to the behavior of stocks. Continue reading "Putting Gold Miners Into Proper Perspective"