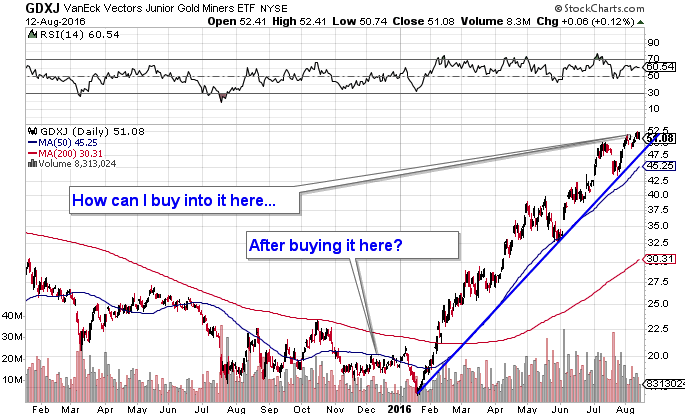

There is an interesting opinion that I have read on the web that it wasn’t Trump who put the metals on the rise as many people think, it could be the Chinese huge economic stimulus instead, as shown in the chart below.

Chart 1. China Government Spending, China Interest Rate

Chart courtesy of tradingeconomics.com

I decided to make my own analysis of the price dynamics to check this assumption.

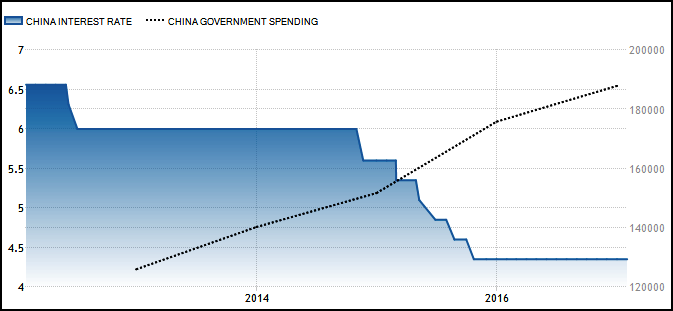

Chart 2. 1-Year Comparative Chart of ETFs and Metals: Synergy Wins!

Chart courtesy of tradingview.com

In the chart above, I have combined three ETFs and three metals for clear illustrations of two important things - the first thing is timing and the second thing is the result of the instrument choices.

The three ETFs are: Continue reading "Love Metals? Good For You!"