So it's Friday and we have come to the end of another trading week and the question is, what positions will you be comfortable holding this weekend? Yes, I know there are lots of problems in Iraq and other parts of the world that can weigh on stock prices, but the reality is, there are always some stocks that are moving up in the world.

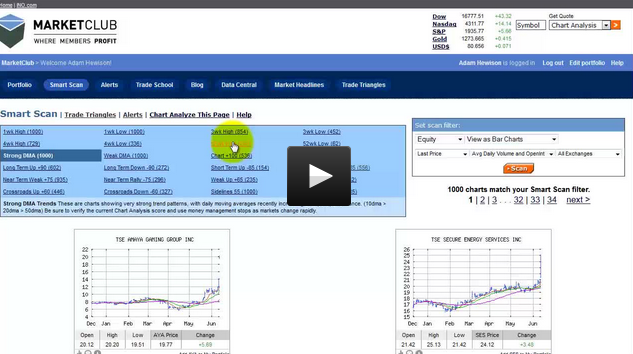

In today's video, I show you how to apply our "52-Week New Highs on Friday" Rules and how you can make money in the very short-term using this simple strategy.

We have had a number of members use this strategy successfully and it is one that you should definitely look into. I will show you the exact steps that you want to take to make this happen for your own account. It's not complicated, it simply is a way to look at the market and determine whether you should be long a stock or short a stock over the weekend.

Every success this weekend with this technique,

Adam Hewison

President, INO.com

Co-Creator, MarketClub