As an asset class, real estate should be a part of every balanced investment portfolio. That’s because real estate investments generally have a low correlation to stocks, can offer lower risk, and provide greater diversification.

Today about 65% of Americans own a home, but that means that tens of millions of Americans have no exposure to real estate. Making matters worse, becoming a homeowner today is harder than in previous generations, with 1 in 5 millennials believing they will never be able to afford a home. Is there a way to get exposure to the real estate market for as little as $100?

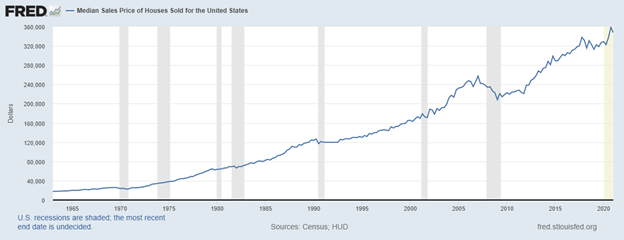

Residential Real Estate Market Trend

From the chart below, we can see that the residential real estate market continues to climb, and the median price of houses sold in the US is near recent all-time highs of $347,500. Even though mortgage rates remain near all-time lows, the appreciation of prices in certain pockets of the country are making many cities and areas simply unaffordable for most. Things look much the same for industrial, commercial, agricultural, and most other specialized real estate subsectors.

How Can You Invest In Real Estate Through The Stock Market

The stock markets offer three different ways you can invest in real estate, and today we will be looking at three of them: REITs, ETNs, and ETFs. Continue reading "Want To Invest In Real Estate?"