With so much news hitting the wires regarding the Treasury Inversion level and the "potential pending recession", we wanted to shed a little insight into this phenomenon and what we believe the most likely outcome to be going forward. Our researchers, at Technical Traders Ltd., believe the Treasure inversion is a reactionary process to overly tight US Fed monetary policies, consumer demand factors and outside cycle forces. There is very little correlation to inverted Treasury levels and causation factors other than the US Fed and global central banks. We believe consumers and consumer sentiment also play a role in setting up the conditions that prompt yield inversion. The one aspect we believe everyone fails to consider is the uncertainty that is associated with major US election cycles.

The US Fed is obviously a driving force with regards to yields and consumer expectations. In the past, the US Fed has rotated FFR levels up and down by enormous amounts (in some cases 200 to 500%+ over very short spans of time. Consumers, you know those people, the ones that are the actual driving force of the local and state level economies, have been the the ones having to deal with wildly rotating FFR levels and the consequences of their debt rotating from 4~7% average interest rates to 8~25%+ average interest rates over the span of just a few years.

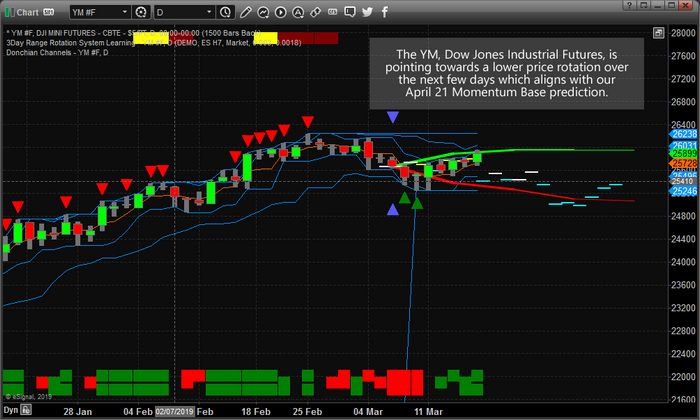

Take a look at this chart that highlights the current and previous US Federal Reserve FFR rate changes. It is quite easy to see that consumers and business, on the receiving end of these changes, often swing from one extreme to another as the US fed makes these dramatic moves. And, yes, that last 2400% number is correct. The FFR went from 0.06% to 2.4% over the past 3+ years – do the math yourself if you don't believe us. Continue reading "Treasury Inversion And Political Fed Cycles"