FIB TIPS AND OTHER HEAD TRIPS

As traders, we are quick to put on mental shackles. Bind ourselves to a way of thinking that lives somewhere between no-sense and nonsense. No trader makes it through unscathed. We all get a little taste of the snake oil in one form or another. However, if you are going to succeed in building your trading business, you must learn how to trade. Interestingly enough, the most powerful tools available in today’s hi-tech trading arena, in my opinion, aren’t the new ones; it’s the tools that are steeped in a rich history, the ancient of days.

- Candlestick Signals - 400 years old

- Fibonacci Sequence - Created “In the beginning” discovered by man recently in 1202

In our previous article, Fibonacci Tips For E-mini Futures Trading, we covered the basics of Fibonacci Retracements in the context of an uptrend. In this article, we will use the same concept and approach, but we will simply apply them in the context of a down trend. This is a large part of why Day trading E-mini Futures is so attractive. Unlike investing in a company where you often wait weeks, months, or even years for the stock to appreciate, E-mini Futures’ profit opportunities are as readily available in a downtrend as they are in an uptrend. Continue reading "Fibonacci Tips For E-mini Futures Trading - Part Two"

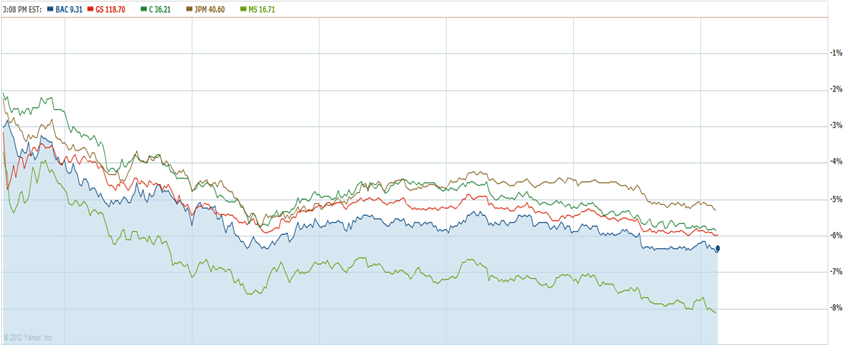

Yahoo Finance

Yahoo Finance