Due to Technical issues we do not have a video at this time. However we are working to add a video from Adam later this afternoon.

Due to Technical issues we do not have a video at this time. However we are working to add a video from Adam later this afternoon.

Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your 1 p.m. market update for Monday, the 8th of August.

Just when you thought it was safe to go back into the water, Standard & Poor's downgrades the US debt for the first time since 1917, back when the US gained its AAA status. Psychologically this is a huge blow for the US, it would appear that we have just been marked down like some product in Macy's bargain basement in New York.

Even though we have the largest debt market in the world, the psychology is such that the move to AA+ was not a good thing for the fragile psyche of the world economy.

Rather than shoot the messenger, in this case Standard & Poor's is saying we should commend the messenger for calling the politician's bluff. We have all heard the expression "no pain, no gain."

Well it's time for pain, and to pay the piper for the excesses of the last 20 or 30 years, which is the last time the US had a positive saving picture. We have a whole generation that basically lives on credit cards.

Last week, we saw trillions of dollars evaporate in the world markets as fear returned and confidence evaporated in a big way.

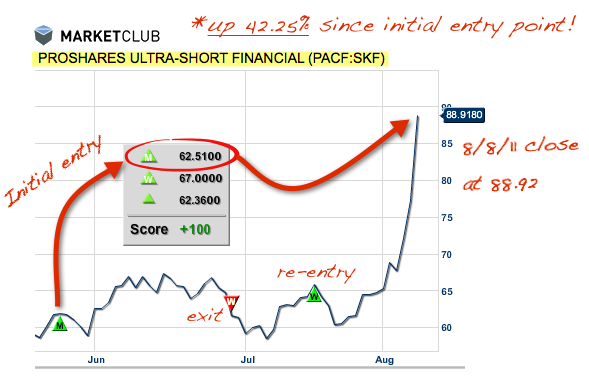

Technically, as you are aware if you've been following this report, you know that all of our Trade Triangles are negative on the equity markets and have been for some time. You also know that we have been steadfastly bullish, based on our Trade Triangle technology on the precious metals.

So what's ahead? There are going to be lots of opportunities in the markets we track and we expect to get our fair share of profits. We expect we will see some form of short covering and profit taking coming into the markets in the next few days, from the sharp downward move we have experienced at the beginning of this week.

Certainly there is no guarantee that this will happen, however most markets do not go straight down. We only have to look back to 2008 and see that we did have rallies in the equity markets. Those rallies were opportunities to short the market. I think any rallies in the current market environment will be opportunities to once again short the equity markets.

So let's go to the 6 major markets we track every day and see how we can create and maintain your wealth in 2011.

Continue reading "Time To Pay The Piper" →

Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your 1 p.m. market update for Wednesday, the 10th of August.

Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your 1 p.m. market update for Wednesday, the 10th of August.

Today we have a special guest blogger, Price Headley of Big Trends. Price is a Traders Hall of Fame inductee and is a regular contributor on CNBC, Fox News and Bloomberg Television, and in a variety of print and online financial news outlets. Today Price will share some of his insight on the recent sell-off and his predictions on the week ahead.

Today we have a special guest blogger, Price Headley of Big Trends. Price is a Traders Hall of Fame inductee and is a regular contributor on CNBC, Fox News and Bloomberg Television, and in a variety of print and online financial news outlets. Today Price will share some of his insight on the recent sell-off and his predictions on the week ahead.  It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.

It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.