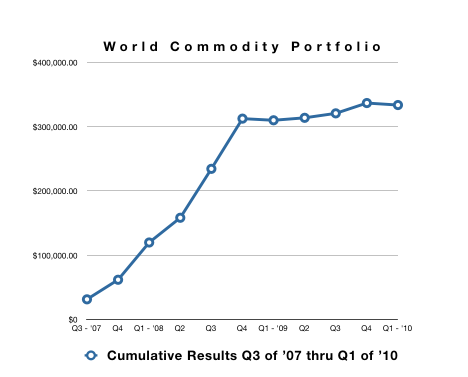

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.

Q1 proved to be a challenging quarter for the "World Cup Portfolio." Out of the six markets we track, we had winning positions in four markets (that's the good news) and losing positions in the other two.

However, the big disappointment in Q1 was the gold market which produced our biggest quarterly loss of any market since we began tracking the "World Cup Portfolio."

The main reason for this loss was the choppy, trend-less action in the gold market. In the eleven quarters we have been tracking gold, we have made money in eight of those quarters. This is not the time to abandon trading gold, rather it is a time to continue with our game plan and "Trade Triangle" approach that has been so successful for this portfolio. Furthermore we have never had back-to-back losing quarters in gold.

On the brighter side, the grain markets proved to be resilient and just the ticket as corn, wheat, and soybeans all put in positive performances. The only other market to put in a negative performance in Q1 was crude oil. Continue reading "Q1: Gold vs. "World Cup Portfolio""

What better day to add a little more "green" to your portfolio than Earth Day? Today we've asked Tate Dwinnell from

What better day to add a little more "green" to your portfolio than Earth Day? Today we've asked Tate Dwinnell from  Position size, or the number of shares you purchase, is a subject often overlooked by many traders. How many of us have an actual method that we use and stick to, or are we arbitrarily using the same number or percentage with each trade? Today, Chuck LeBeau, who is soon to be inducted into the “Traders' Hall of Fame," an INO TV author, and exit strategy specialist has stopped by to introduce a positioning method that can be introduced into any portfolio.

Position size, or the number of shares you purchase, is a subject often overlooked by many traders. How many of us have an actual method that we use and stick to, or are we arbitrarily using the same number or percentage with each trade? Today, Chuck LeBeau, who is soon to be inducted into the “Traders' Hall of Fame," an INO TV author, and exit strategy specialist has stopped by to introduce a positioning method that can be introduced into any portfolio. It would seem that investors and

It would seem that investors and