While the Gold Miners Index (GDX) has been a sanctuary in the turbulent market environment, the Silver Miners Index (SIL) has not fared as well. This is evidenced by its 2000 basis point underperformance vs. the GDX, partially explained by the weaker margin profile for silver producers. The good news is that this underperformance is setting up a buying opportunity, with a few names trading at more reasonable valuations.

The Silver Miners Index is made up of several silver miners, but like the GDX, 70% of the miners in the index have short mine lives based on reserves and slim margins. This makes owning the SIL ETF difficult, given that companies within the index need to acquire other companies to replace reserves vs. accomplishing it organically, which often leads to share dilution. One of the ways to reduce exposure to the sector laggards is by owning the highest-quality names, and in this update, we’ll look at three names that stand out that do make for worthy investments: Hecla Mining (HL), SilverCrest Metals (SILV), and Wheaton Precious Metals (WPM).

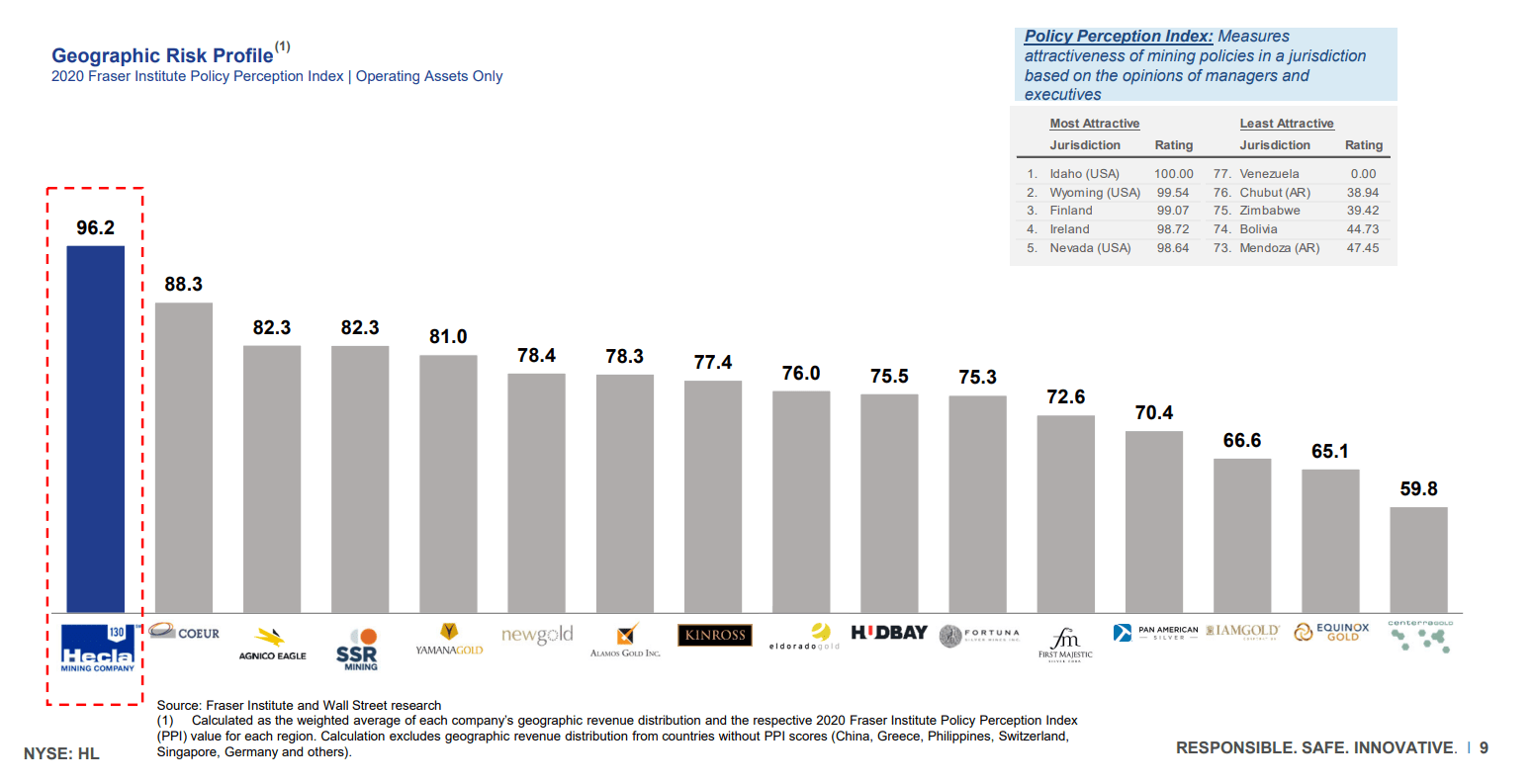

The first name on the list is Hecla Mining (HL), a silver producer with operations in Idaho, Alaska, and Quebec (Canada). The company also has organic growth potential in Montana and Nevada, and it expects to produce over 43MM ounces of silver this year from its three operating assets. While there are a few producers with larger production profiles than Hecla, its key differentiator is that it’s focused on high-grade assets in safe jurisdictions, as the chart below displays.

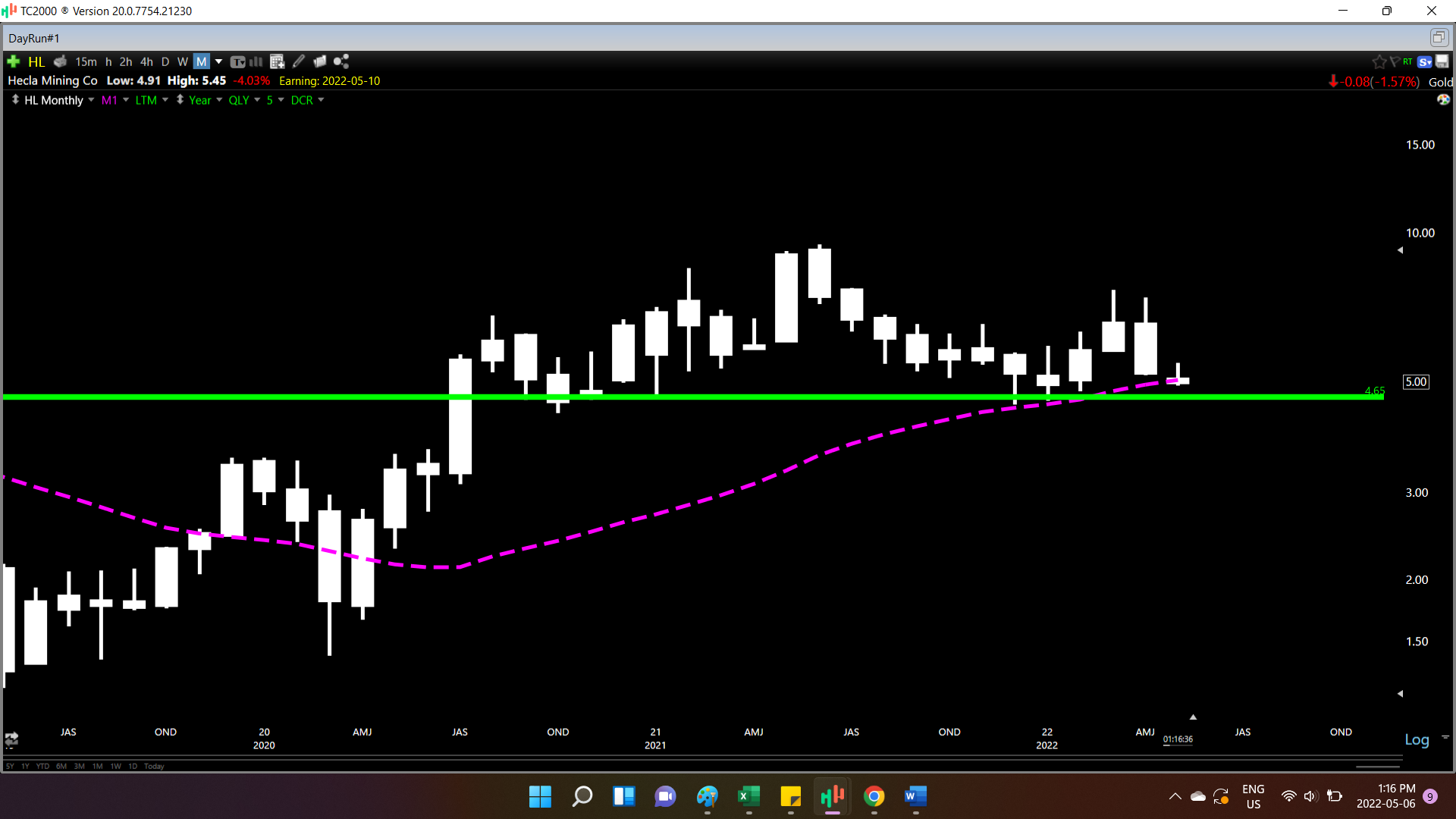

In addition, Hecla has some of the highest margins among its peer group, expecting to produce silver at less than $12.00/oz, with the potential to beat this cost guidance due to higher zinc prices which will help with by-product credits. Given this mix of high-grade reserves, steady reserve replacement at its assets, and safe jurisdictions, it is one of the sector’s better buy-the-dip candidates. It would become very interesting below $4.80 per share, near its multi-year support level.

The second name on the list is Wheaton Precious Metals (WPM), a royalty/streaming company. For those unfamiliar, royalty/streaming companies provide an upfront payment to gold/silver producers and or gold/silver developers to help finance their project's initial construction or future expansions. In exchange, royalty/streaming companies receive a portion of production over the asset’s life.

In WPM’s case, the company’s business model is focused on streams, which entitle the company to purchase a portion of metals over the mine life, but it must make a small payment for each ounce delivered. In the example of its recent stream with Sabina Gold & Silver (SGSVF), it paid $125MM to receive 4.15% of gold production from the Goose Mine for the first 130,000 ounces for 18% of the spot gold price ($324/oz at $1,850/oz gold).

In addition to the stream on the Goose Mine in Nunavut, which is under construction, Wheaton has made several other bets over the past year, including the Curipamba Copper-Gold Project and the Marathon Platinum Group Metals Project. These acquisitions have improved the company’s 10-year outlook to 910,000 gold-equivalent ounces [GEOs] per annum, a massive improvement from its previous guidance of 830,000 GEOs and FY2022 guidance of ~730,000 GEOs.

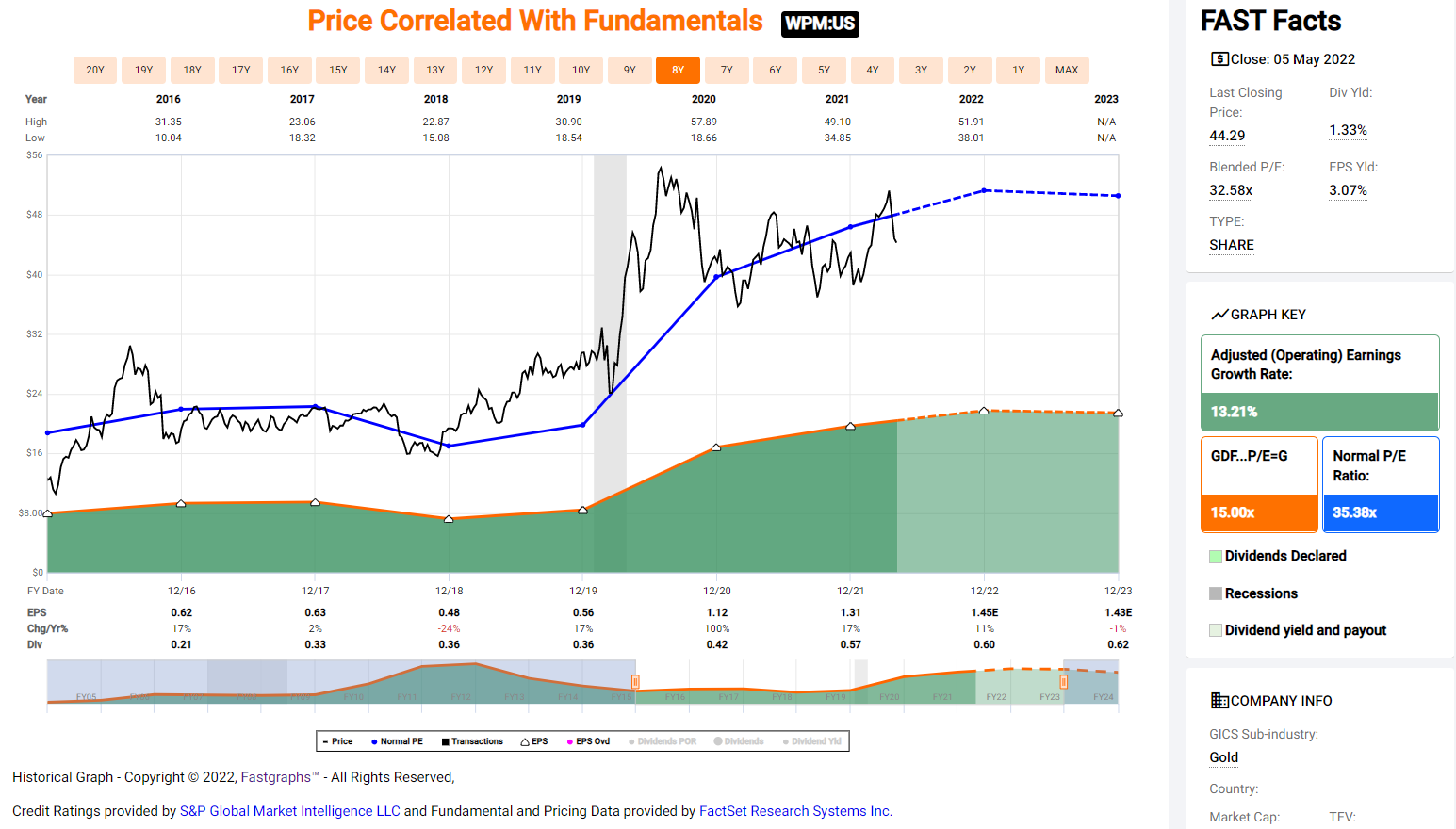

Since the end of the 2015 secular bear market, WPM has traded at ~35x earnings and currently trades at ~30x earnings at a share price of $44.00. However, with gold and silver in the upper portion of their 8-year ranges, I would argue that WPM could easily command an earnings multiple of 38, translating to a fair value of $55.10 based on FY2022 earnings estimates ($1.45). So, if the company were to trade 25% below this level ($41.30), where investors have an adequate margin of safety, this would present a buying opportunity.

The final name on the list is SilverCrest Metals (SILV), a silver company ready to graduate to producer status at its Las Chispas Project in Mexico. The company has a strong track record of success, having been acquired just seven years earlier for its Santa Elena Mine in Sonora State, and to date, it’s done an excellent job at Las Chispas. This includes uncovering one of the highest-grade projects globally with an average grade that’s just shy of 1 kilogram per tonne silver equivalent, with higher-grade pockets of the resource that come in above 1,300 grams per tonne silver equivalent.

As it stands, SilverCrest has a 130MM ounce resource base, and its high grades contribute to the company being on track to have some of the lowest costs sector-wide at ~$8.00/oz or less. It’s worth noting that this resource does not include its El Picacho Project, which could potentially boost the mine life and production profile down the road (material could be trucked to Las Chispas). This 130MM ounce resource is based on only one-third of the known veins on the Las Chispas Property.

Typically, we see an upside re-rating when silver developers graduate to producer status, and I would be shocked if this wasn’t the case for SilverCrest. In fact, I would not be surprised to see the stock head above $11.00 per share once the asset ramps up to full production by Q1 2022, given that it should receive a premium valuation for being one of the highest-margin producers in the sector. Hence, I see this pullback below $7.50 as a low-risk area to start an initial position in the stock.

While the silver sector can be a minefield due to the large number of low-quality producers that cannot execute successfully, WPM, SILV, and HL are exceptions. Therefore, I believe these are three names worth keeping at the top of one’s watchlist for investors looking for exposure to the space.

Taylor Dart

INO.com Contributor

Disclosure: This contributor held a long positions in SILV at the time this blog post was published. This article is the opinion of the contributor themselves. Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.