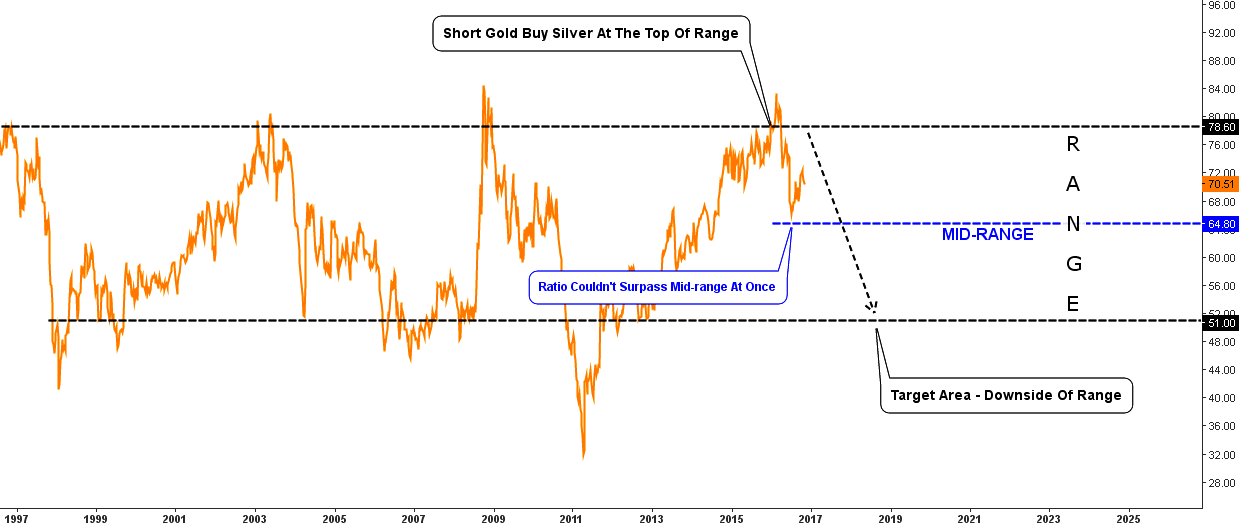

In February I posted an idea to short gold and buy silver simultaneously at the 79 oz level as the ratio hit the top of the multi-decade range. The progress was surprisingly good and I wrote about it in July update and then the ratio stalled. Today I would like to show how we can use this respite to pocket gains.

Below is the ‘face-lifted’ February chart where I put focus on the main idea.

Chart 1. Gold/Silver Ratio: Mid-Range Set Strong Barrier

Chart courtesy of tradingview.com

This is the so-called ‘bird’s-eye’ view of the ratio. Twenty years in the range with rare overshoots beyond the range and the single ultra-strength of silver in 2011, this could be titled as the fearless or careless time as you wish. Continue reading "Gold/Silver Ratio: Another Chance To Short?"