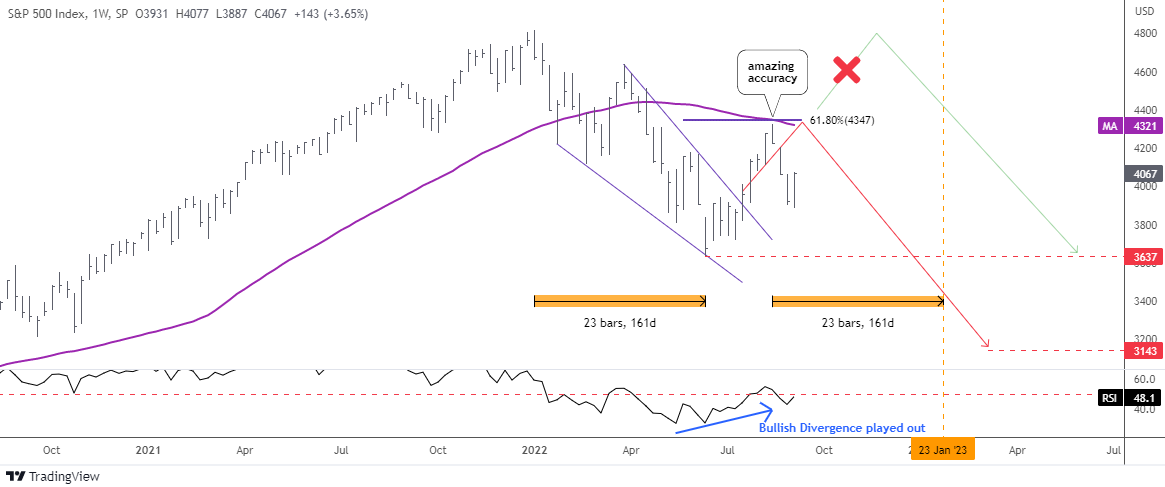

It’s time to update the S&P 500 index chart as it emerged inch-perfect since the last update in July.

To refresh your memory, I kept the main paths untouched and added new crucial highlights.

The idea of the upcoming breakout of the Falling Wedge pattern (blue converging trendlines) was posted right on time on the Blog as it played out instantly. Indeed, the Bullish Divergence of the RSI indicator with the price chart played out as planned supporting the breakup of the pattern’s resistance.

The majority of readers got it right choosing the red path as a primary scenario. The price action has been amazingly accurate in the 61.8% Fibonacci retracement area where the price failed to overcome the barrier and reversed to the downside from the minor top of $4,325 following the red zigzag.

I added the 52-week simple moving average (purple) to show you how strong the double resistance was at the $4,347-$4,349 level.

The next support is located in the valley in June at $3,637. Continue reading "Gold/Silver Ratio Shows S&P 500 Is On The Edge"